French fintech: 455 million euros raised in the first half of 1

Paris, the 30 June 2020

France FinTech, the professional association of French fintech, insurtech and regtech, publishes its biannual fundraising barometer.

French fintech fundraising, sustained activity in June 2020

Data from June 2020 demonstrate that the COVID crisis has not interrupted capital raising operations. With 123,2 million euros raised in 5 operations, the average ticket is over 30 million euros.

Data from June 2020 demonstrate that the COVID crisis has not interrupted capital raising operations. With 123,2 million euros raised in 5 operations, the average ticket is over 30 million euros.

The lift volume is significantly higher than the previous two months (€ 56,7M in April 2020, € 22M in May 2020), very marked by the wait-and-see attitude of the players.

“It is of course far too early to conclude that the impact of the COVID 19 crisis on fintech capital funding is behind us, but the analysis from June is quite encouraging. Investors still seem to consider that our ecosystem has great potential for development. Trend to be confirmed in the coming months » comments Alain Clot, President of France FinTech

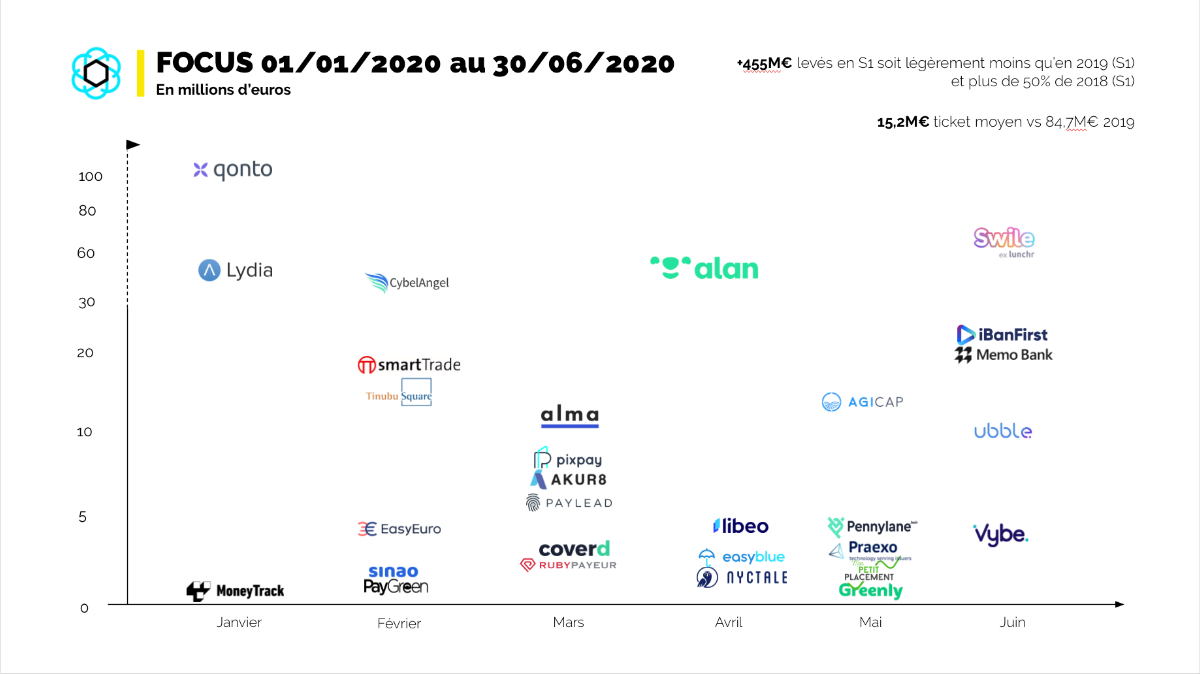

Cumulatively between January 1 and June 30, 2020, 455 million euros were invested for 30 operations, for an average of 15,2 million euros per fundraising. This figure is close to that of the first half of 2019 (508,3 million euros raised in 30 operations)(1), which had been strongly marked by the lifting of Kyriba for 142 million euros.

The year 2020 has had a promising start in particular with the announcement of Lydia (40M €), followed by Qonto (104M €), Cybel Angel (33M €), Alan (50M €) and Swile - ex Lunchr (70M €) . Note the arrival of global investors which tends to confirm the attractiveness of our ecosystem. The trend suggests that the 2020 vintage could ultimately be less impacted by the crisis than one might fear.

A dynamic sector: some data on the ecosystem

- Nearly 600 fintech, insurtech and regtech make up the French panorama.

- 3 French unicorns (Ivalua, Kyriba, Dataiku)

- 2nd sector in terms of fundraising in 2019 (after Healthtech)(2)

- After operational services in 2019 (42,7%), the Banking / PFM category is, for the moment, the most important in value (38,3%), followed by payment services (22,6%) and insurance (16,7%).

- With operational services remaining to date, the largest category in terms of volume (23,3%), tied with payment services.

- 8 players are part of Next40 (20%) and 17 of FrenchTech120 (13,8%), making it the most represented sector.

- Nearly 700 partnerships concluded(3) in 2019 within the French fintech ecosystem.

Besides of course the consequences of the Covid 19 crisis, the challenges of this year are multiple: internationalization, viability and diversification of offers. All these themes will be dealt with during our big annual event, Fintech R: Evolution next Thursday, October 15 at Station F, subtitled Beyond Frontiers.

(1) Source: France FinTech 2019

(2) Source: In Extenso 2019

(3) Source: JDN 2019

See also:

About France FinTech:

Created in 2015 on the initiative of entrepreneurs, France FinTech brings together companies using operational, technological or economic, innovative and disruptive models, aimed at addressing existing or emerging issues in the financial services industry and representing the main components of the Faculty.

The association's mission is to promote excellence in the sector in France and abroad and to represent French fintechs to public authorities, the regulator and the ecosystem. It is chaired by Alain Clot and Kristen Charvin is its general delegate. Its steering committee brings together the founders and directors of ANAXAGO, BANKIN, EPSOR, LEDGER, LYDIA, OCTOBER, XAALYS, YOUNITED CREDIT.

contacts: press@francefintech.org

Kristen charvin

France FinTech - General Delegate

kristen.charvin@francefintech.org