The Covid 19 will not get the better of French fintech!

In the midst of the second confinement - which unfortunately will not be the last - and at the start of the resulting economic crisis of unprecedented magnitude, how is French fintech doing?

Surprise, surprise ...

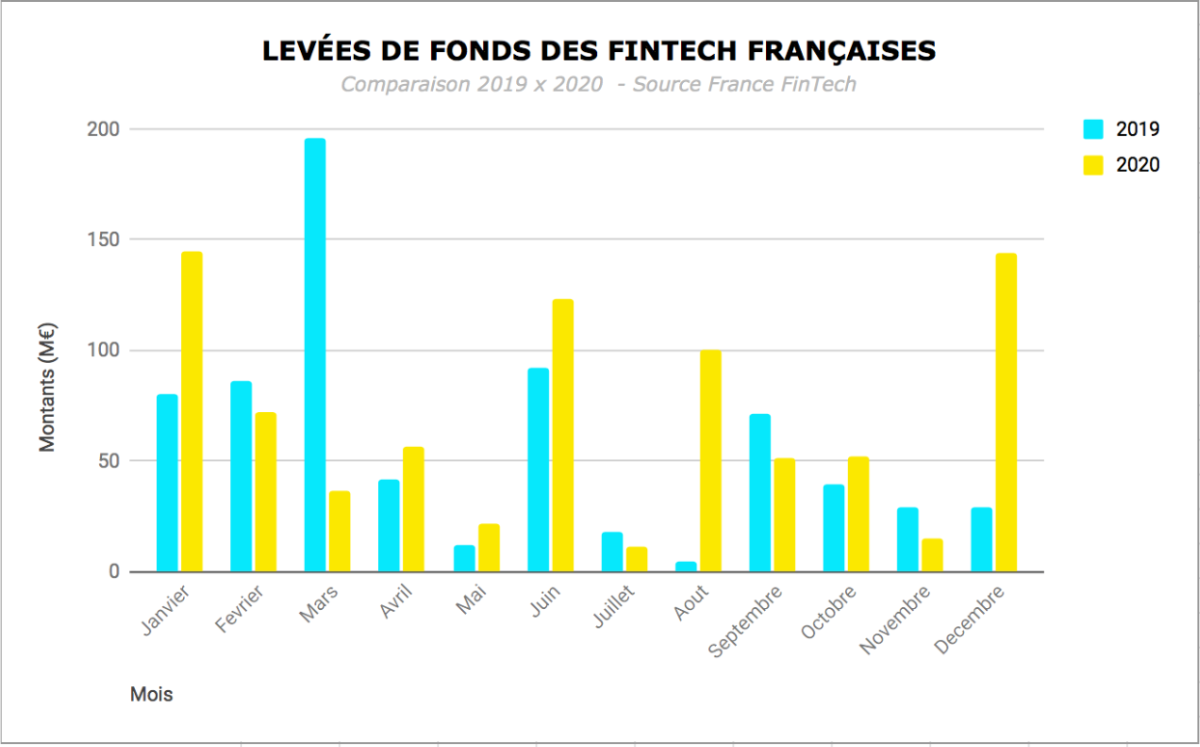

Our year 2020 had started “with a bang” with strong growth in all the usual aggregates: number of fintechs (which now exceeds 650), growth in turnover and results. Fundraising, an interesting indicator, reached € 253 million in the first quarter (36% of the total amount for 2019).

The pandemic has obviously caused the same astonishing effect on our entrepreneurs and their partners as on all the other players in economic and social life. Initially, the activity contracted, in particular that linked to physical commerce, to events and in general to social relations. Access to financing dried up for several weeks, in a French context, let us remember, in which start-ups have little access to bank credit.

Adaptation, reaction and rebound!

FinTechs have quickly adapted: recourse to teleworking with which they are already familiar, reduction of costs, postponement of certain non-essential projects and dialogue with their customers, partners and employees.

It should be noted that they very quickly mobilized to contribute to the "war effort": support in particular for caregivers, vulnerable populations and VSEs-SMEs (we have identified more than a hundredsolidarity initiatives). As such, we have ensured, by helping to have a legislative amendment adopted with the support of Bercy, the association of crowdfunding platforms with PGEs (loans guaranteed by the State).

Finally, funding quickly returned: business angels, funds, including foreigners who are increasingly interested in our fintech.

In this unprecedented context, the ecosystem has shown itself to be generally resilient and responsive; the 2020 results should be rather good.

The amount of cumulative lifting hit € 827,9 million for 62 operations (compared to € 699 million for 64 raised in 2019), with morevery fine operations: Dataiku (100M) - Qonto (104M) - Lydia (40M) - Swile (70M) - Alan (50M) - Luko (47,6M).

The amount of cumulative lifting hit € 827,9 million for 62 operations (compared to € 699 million for 64 raised in 2019), with morevery fine operations: Dataiku (100M) - Qonto (104M) - Lydia (40M) - Swile (70M) - Alan (50M) - Luko (47,6M).

The average ticket is also increasing (€ 13,4 million against € 10,9 million in 2019).

The French ecosystem is therefore seeing its fundraising increase by 18,4%, against a drop of 7% for the European sector. Subject to any end-of-year operations, our share of the whole therefore increased by almost 2% (8,8% of the total).

The overall volume of business increased significantly due in particular to increased use of applications and the digitization needs of many uses related to financial services.

See Barometers France FinTech

2021 and beyond ...

It is still difficult to measure the economic impact of the pandemic and predict its future repercussions, but we can already identify some consequences and distinguish the main trends.

Obviously, the economic crisis generated by the successive confinements will be deep and long. Fintechs, which in this regard are “companies like any other”, will be impacted in the same way as traditional financial players, including by an inevitable deterioration of risks (companies and individuals). Note, however, that few fintechs have a credit institution status.

In the longer term, the trends already observed should accelerate, foremost among which is the development of online finance. In fact, BtoC models are experiencing a marked development and it seems that BtoB solutions allowing a rapid digitalization of the customer experience are registering a growing mark of interest. At the same time, a number of BtoC models have launched a BtoB offer which represents a part of their growing activity (note that they are thus following the strategic path of big tech, etc.).

The internationalization of uses and players will continue, as will the phenomenon of platformization. Artificial intelligence and latest generation algorithms are having an increasingly strong impact on models (advice, risk, productivity in particular). We should also note the ever-increasing interference of American and Chinese Big Techs in financial services, which are now elevated to the rank of strategic priority.

Segment by segment, champions are emerging and confirming their position, reflecting the start of consolidation.

Finally, let us mention the recent and promising emergence of new bricks of use and models which are added to the offers already installed.

In particular, I will mention four families (among many others):

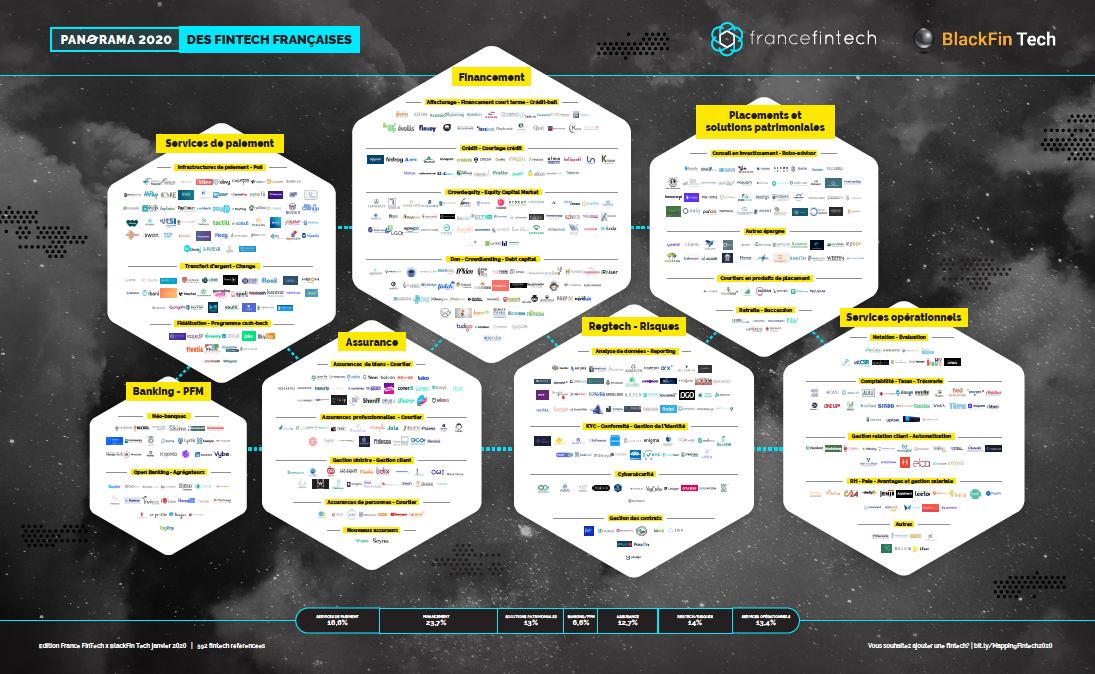

- fintechs that target what are called “functional services” (internally managed, as opposed to commercial operation). 23,5% of fundraising in value.

The creativity of our entrepreneurs in this sector is strong. These include what is commonly called “the economy of the invoice and expense report” and the solutions dedicated to the purchasing function, the financial services associated with the HR function (employee savings, payroll advances, etc. ). There has been a development of “Business Intelligence” tools (decision support) and a whole range of offers covering risk analysis.

- the neo-banking sector (31% of raises)

This compartment is stimulated by the rise of open finance and the enactment of the second European directive on payments (PSD2). It is characterized by the expansion of the range of products and services and the targeting of new customer segments (professionals, entrepreneurs and VSEs, young people under 15);

- assurtech (21% of raises)

Digital insurance services are one of the fastest growing sectors, with the emergence of new insurers, on-demand insurance providers, parametric insurance or data management functionalities.

In fact, the three sectors (functional services, new banking and insurance) together represent three quarters of fundraising for the year.

- impact models

As everyone knows, societal and environmental concerns take a central place in the decision-making criteria of consumers (not just the youngest).

The translation of this basic trend is materialized by the development of neo-bank type fintech for the sustainable economy, fintech offering responsible investments, the measurement of the carbon footprint of our financial decisions or financial education.

For a broader view of the ecosystem, see the Panorama of French fintech from France FinTech x BlackFin Tech

We are clearly entering a decisive period for both traditional players (banking and insurance) and new entrants.

The economy of alternative finance is indeed in strong development under the pressure of the four engines of innovation (financing, regulation, technology and consumer demand) which grow strongly and concomitantly.

In this environment and faced with the arrival of Big Techs in financial services, it is essential not to waste time and especially to listen to the expectations of (new) consumers.

France, a market for skills and access to Europe, has a good card to play.

The pandemic period does not introduce a break, but rather constitutes a trend accelerator and a revealer of talent that our fintech have set out to seize with enthusiasm

Alain Clot

President and founder, France FinTech

About France Fintech

Created in 2015 on the initiative of entrepreneurs, France FinTech brings together companies using innovative and disruptive operational, technological or economic models aimed at addressing existing or emerging issues in the financial services industry and representing the main components of the sector. The association's mission is to promote the excellence of the sector in France and abroad and to represent French fintech to the public authorities, the regulator and the ecosystem. France FinTech is today the largest sectoral association of start-ups in France and in Europe. It is chaired by Alain Clot and Kristen Charvin is its general delegate. Its steering committee brings together the founders and directors of ANAXAGO, BANKIN, EPSOR, LEDGER, LYDIA, OCTOBER, XAALYS, YOUNITED CREDIT. In addition to its actions in the regulatory and legislative fields, its numerous publications, its workshops and various meetings, the association organizes each year the reference event of the ecosystem, Fintech R: Evolution.

France FinTech is a member of the AMF-ACPR Fintech Forum and a founding member of theEDFA (European Digital Finance Association).

www.francefintech.org | Twitter | LinkedIn | Youtube | Discover our , and our partners | Join us !