Morale of fintech entrepreneurs: reasoned optimism

The observatory on the economic future

VIAVOICE-GCF SURVEY FOR FINTECH R:EVOLUTION 2022

In this section:

MAIN LESSONS

The

RESULTS

Footnotes

Technical

MAIN LESSONS

In a general context marked by several crises (war in Ukraine, health crisis, etc.), economic signals are partly divergent, particularly for fintechs. Between inflation, rising rates, loss of valuations of certain fintechs on the one hand and the pursuit of global activity, fundraising and recruitment on the other. In this context and to better understand future prospects, the Observatory on the future economy Viavoice in partnership with the GCF carried out for France FinTech compares the visions of fintech with those of decision-makers in private companies, around the state of the spirit of the leaders, their wishes for investments, fundraising, recruitment, but also their concerns and their vision for the coming year

In a general context marked by several crises (war in Ukraine, health crisis, etc.), economic signals are partly divergent, particularly for fintechs. Between inflation, rising rates, loss of valuations of certain fintechs on the one hand and the pursuit of global activity, fundraising and recruitment on the other. In this context and to better understand future prospects, the Observatory on the future economy Viavoice in partnership with the GCF carried out for France FinTech compares the visions of fintech with those of decision-makers in private companies, around the state of the spirit of the leaders, their wishes for investments, fundraising, recruitment, but also their concerns and their vision for the coming year

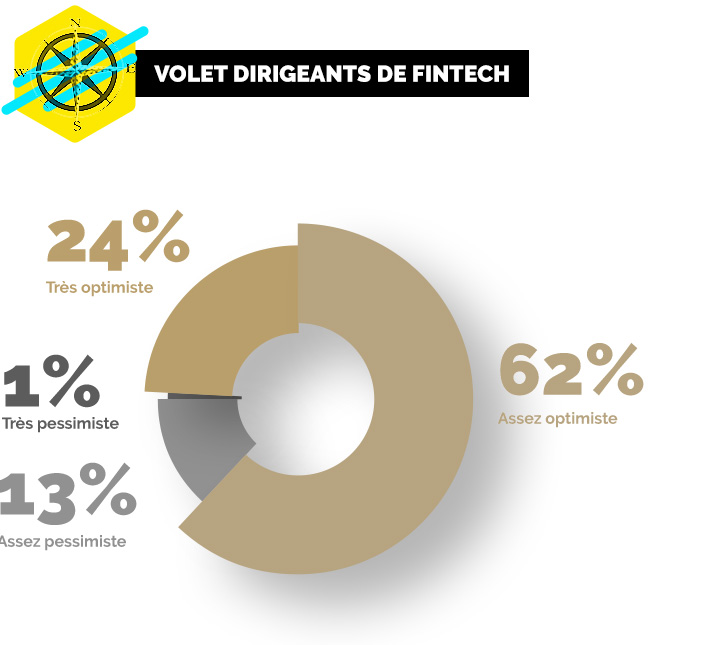

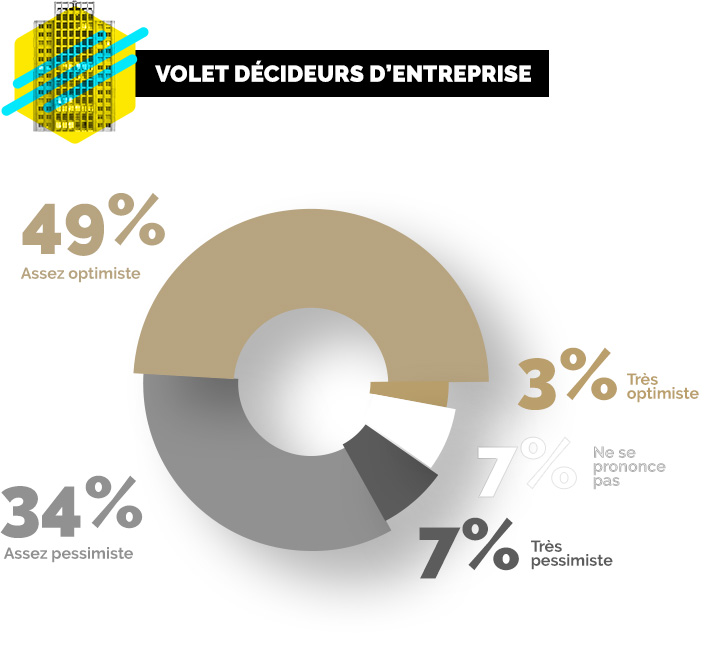

Amid the general uncertainty, fintech executives are showing cautious economic confidence: 62% say they are “somewhat optimistic” about their company's economic situation, and 24% “very optimistic”. This majority but tempered confidence is largely due to the current macro-economic and macro-financial uncertainties, and to the difficulties likely to arise in terms of financing. However, this optimism of the “fintech galaxy” is higher than that expressed by decision-makers within private companies: 49% consider themselves “fairly optimistic” and only 3% “very optimistic”.

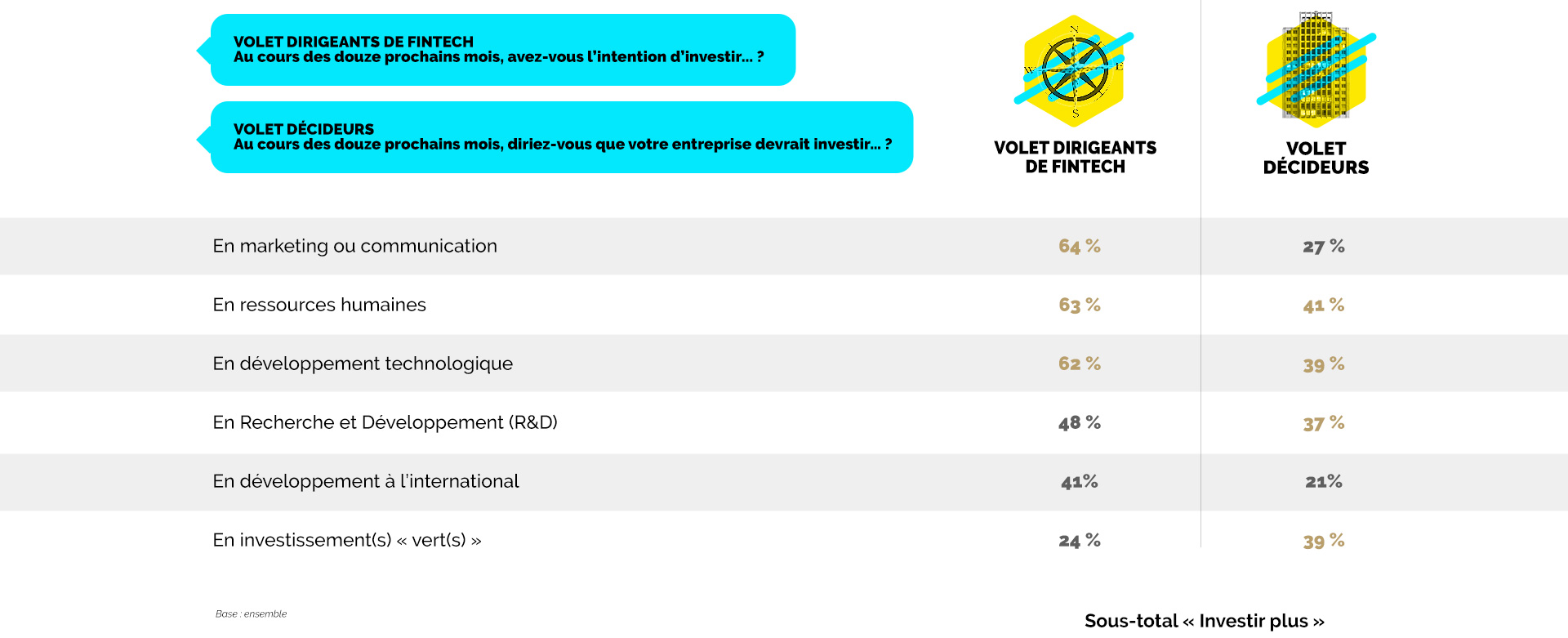

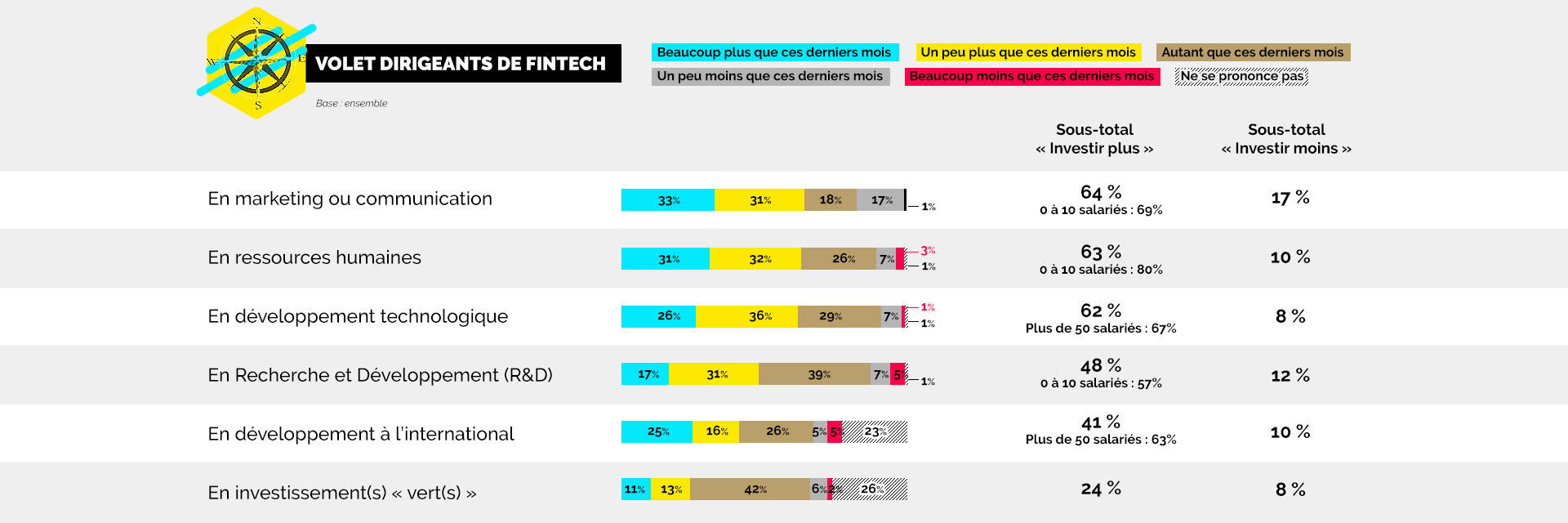

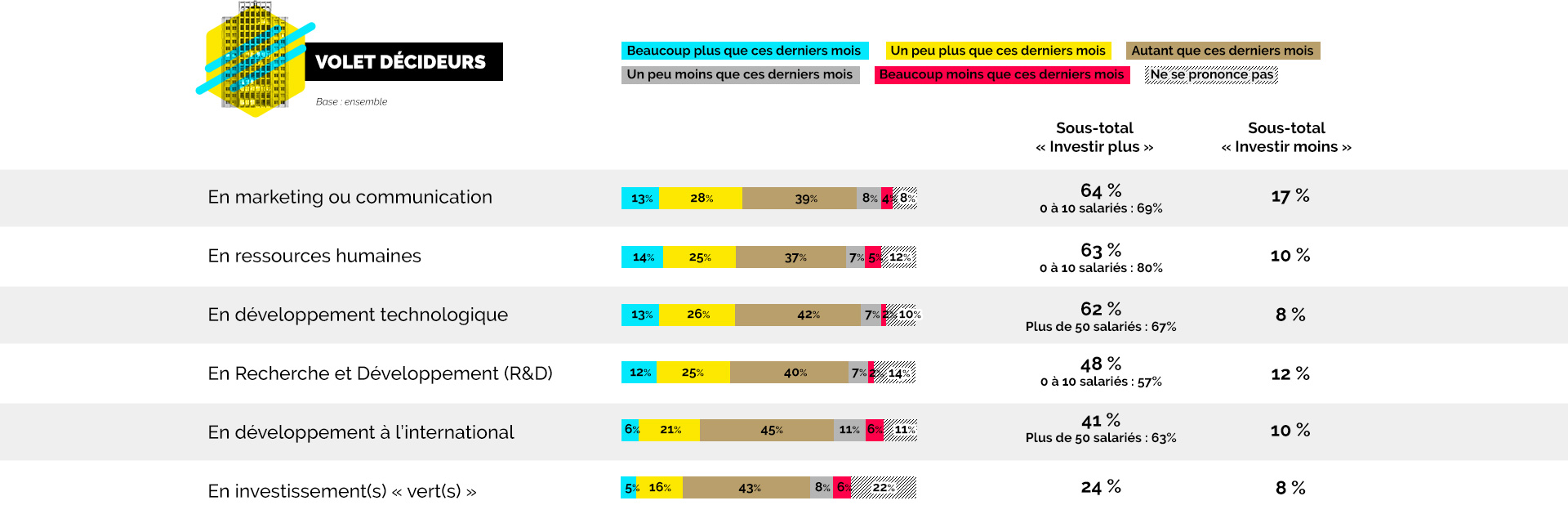

When it comes to investments over the next twelve months, a majority of fintech executives want to invest more in particular in marketing or communication (64%), human resources (63%) and technological development (62%).

Overall, the vast majority of fintechs intend to invest as much or more than in recent months, despite divergent signals linked to the economic situation. In detail, certain investments are favored according to the size of the fintech, thus small fintechs investing more, direct their investment more in human resources, marketing or communication when fintechs with more than 50 employees wish to invest more, the orient towards technological or international development. Decision makers are more divided, if they want to invest more in human resources (41%) and green investments (39%), they plan for a large part of them to maintain their investments in technological development , research and development, marketing and communication as well as international development. We should also note disparities according to the profile of companies and a very majority propensity to maintain or increase investments overall.

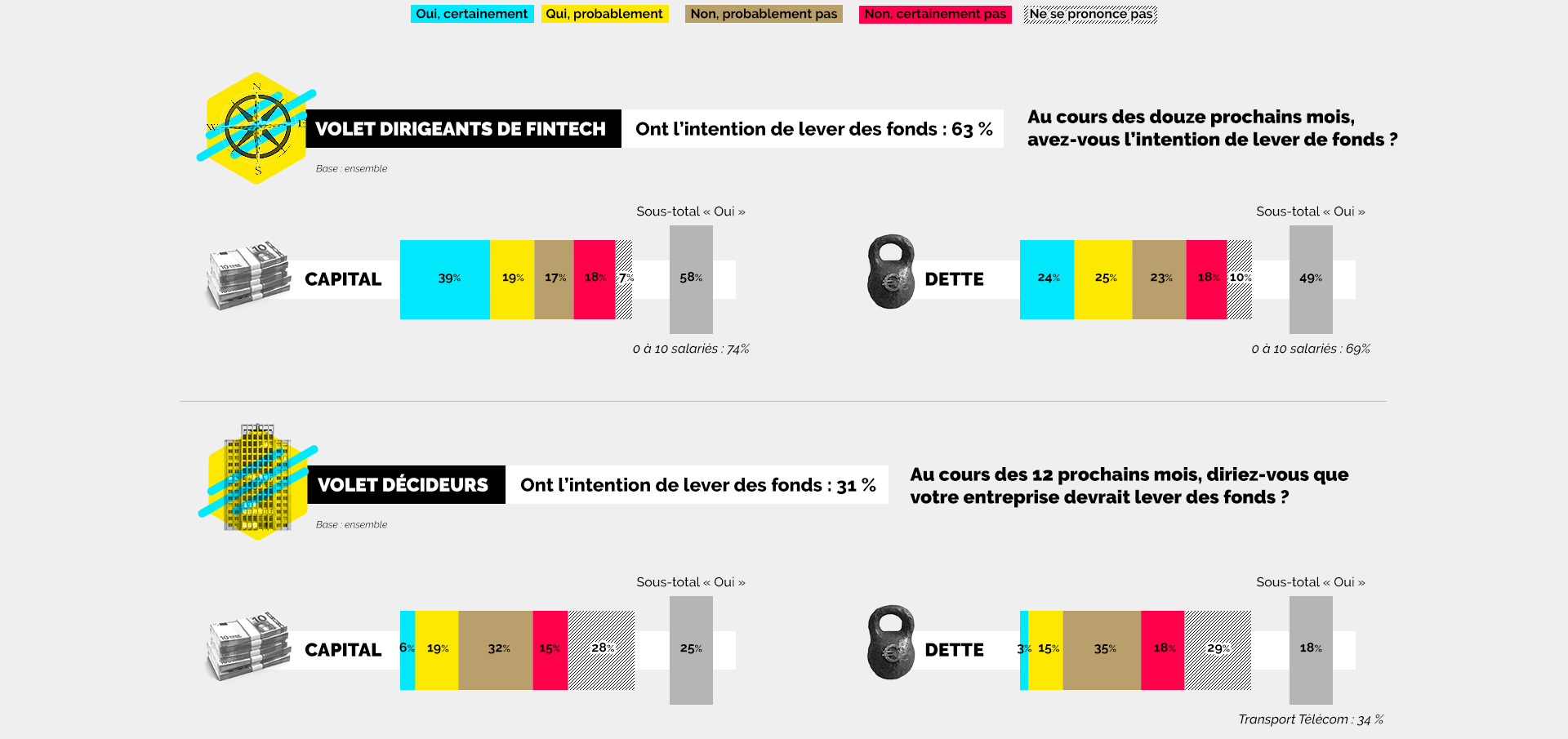

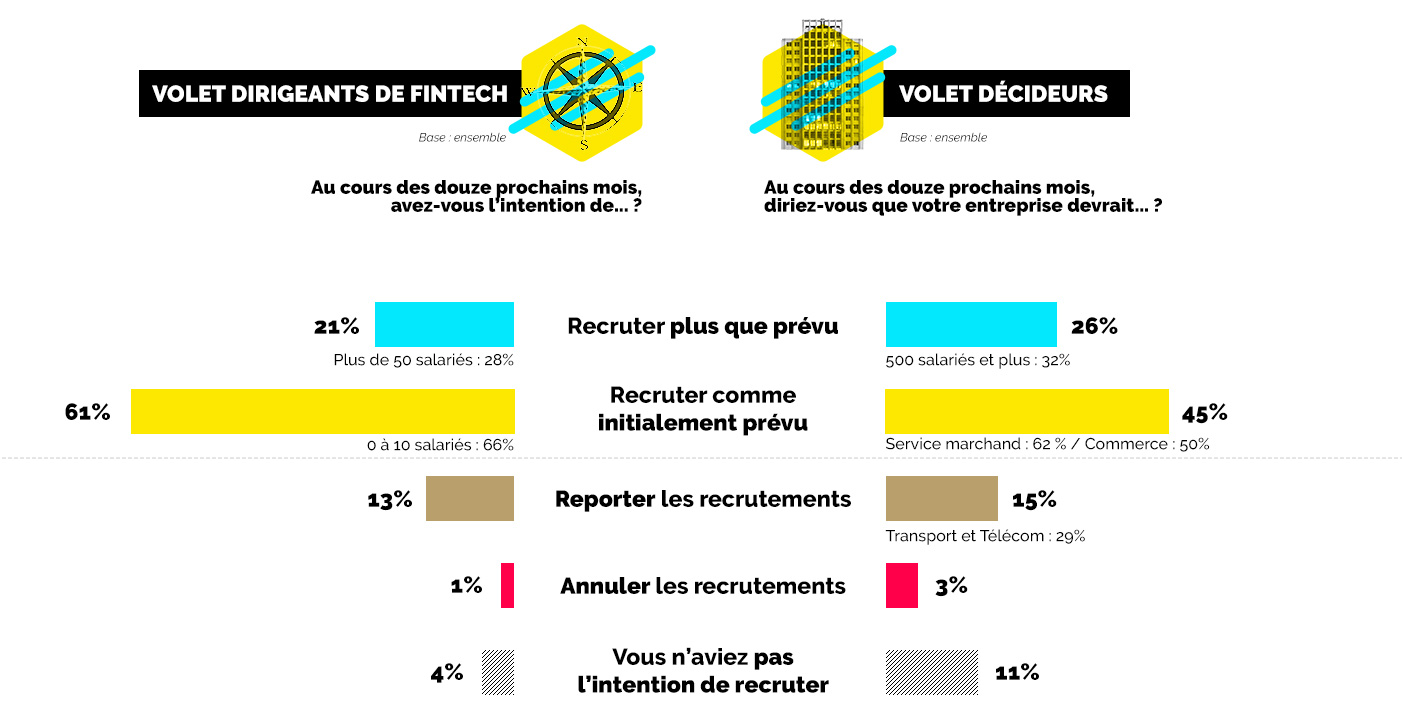

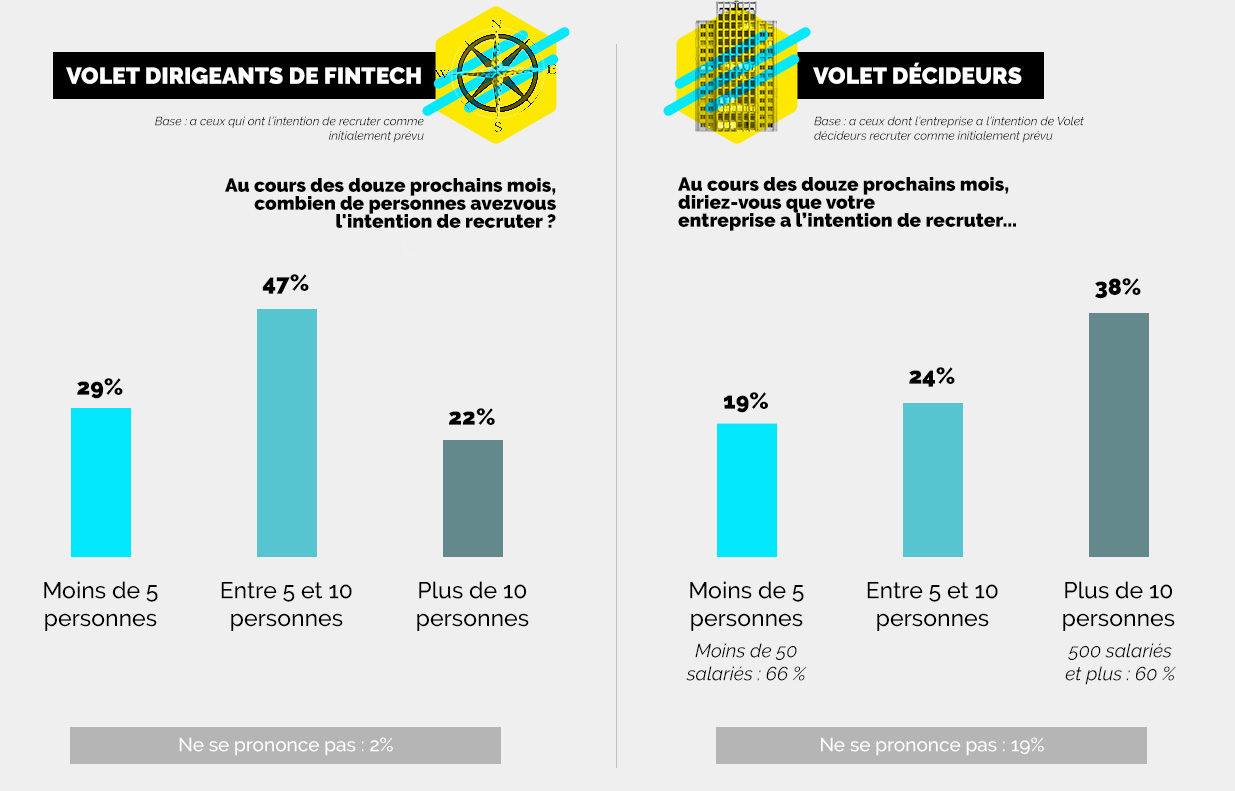

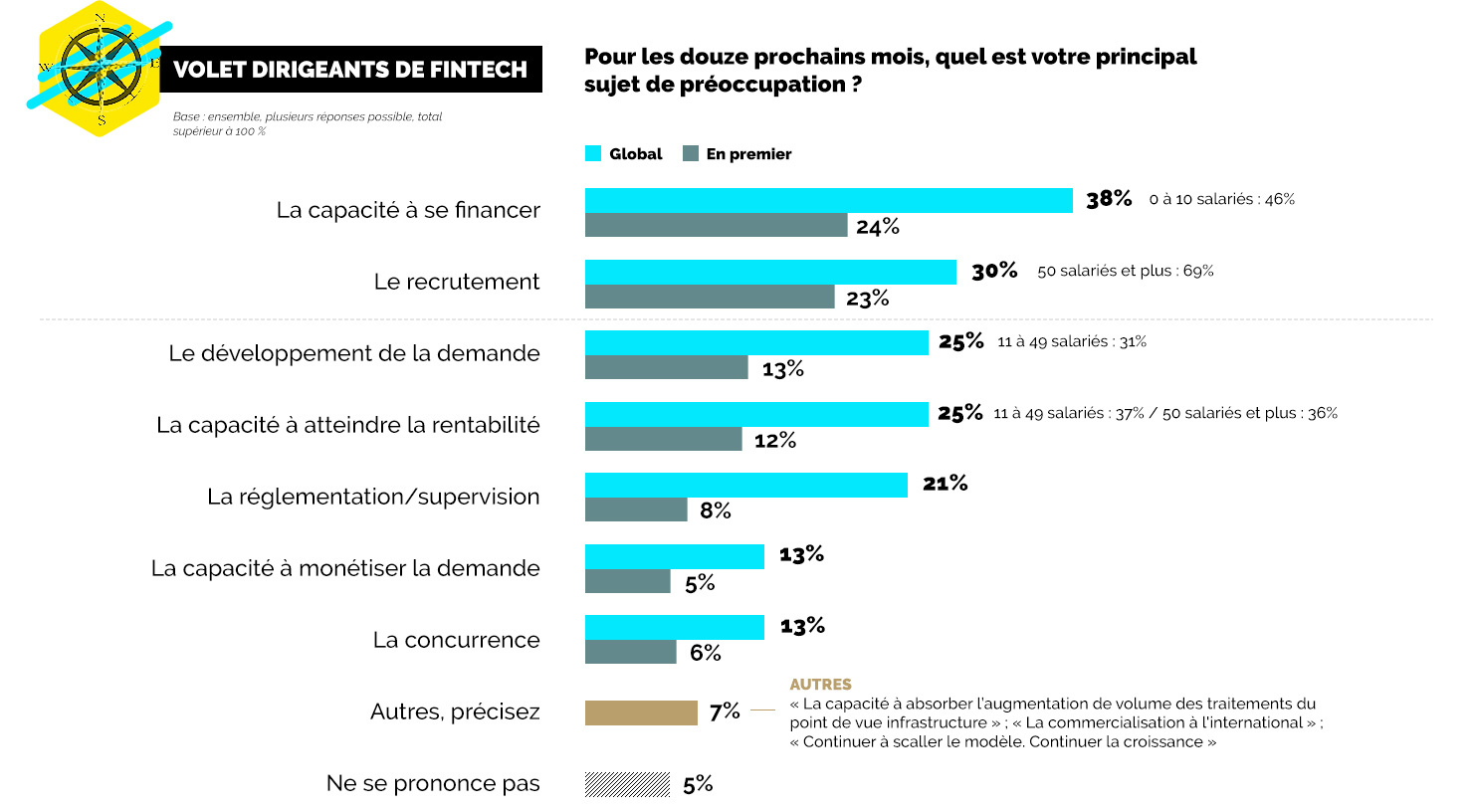

When they intend to raise funds in the next twelve months (63% of fintech executives and 31% of decision-makers), they favor the use of capital (respectively 58% and 25%) rather than debt (49% and 18%). Regarding their intention to recruit over the next twelve months, fintech executives and decision-makers overwhelmingly state that they intend to recruit whether it is as initially planned or more than expected (82% of members and 71% of decision-makers). In detail, nearly half of these two targets say they are not changing their recruitment plans (61% and 45% respectively), with additional recruitment being more the prerogative of larger structures. For the next twelve months and about their main concerns, fintech leaders highlight the ability to finance themselves (38% of which 24% "In Premier") and recruitment (30% of which 23% "In Premier") . These two items are ahead of the development of demand (25%) and the ability to achieve profitability (25%) cited less markedly first by the interviewees. Regulation, the ability to monetize demand and competition appear to be less significant in members' perceptions.

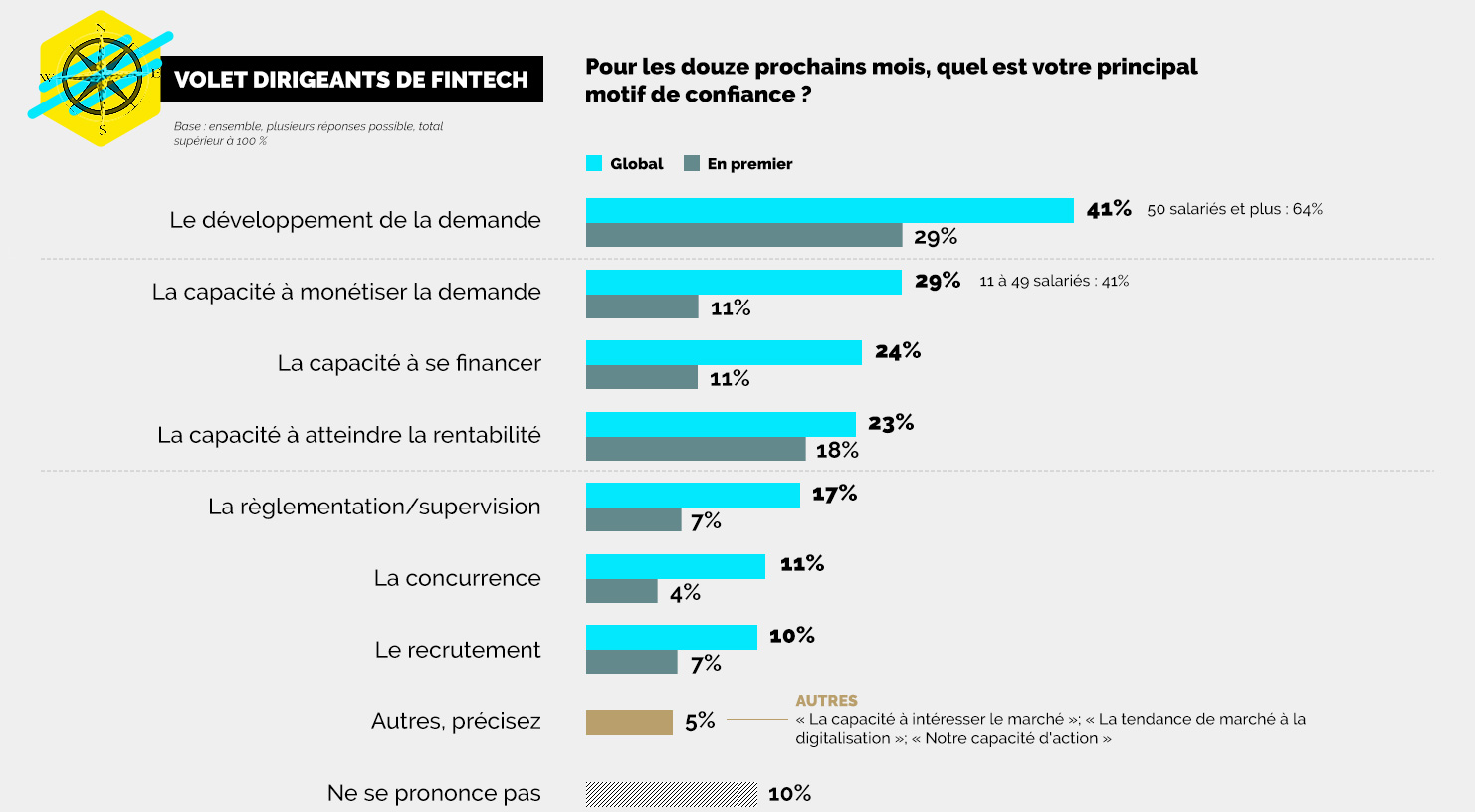

When asked about their reasons for confidence over the next 41 months, 29% of fintech executives cite demand development. In detail, 29% of members even cite this item first, a higher score than the other items. Thus, to a lesser extent, the interviewees also mention the ability to monetize demand (24%), the ability to finance themselves (23%) or the ability to achieve profitability (XNUMX%).

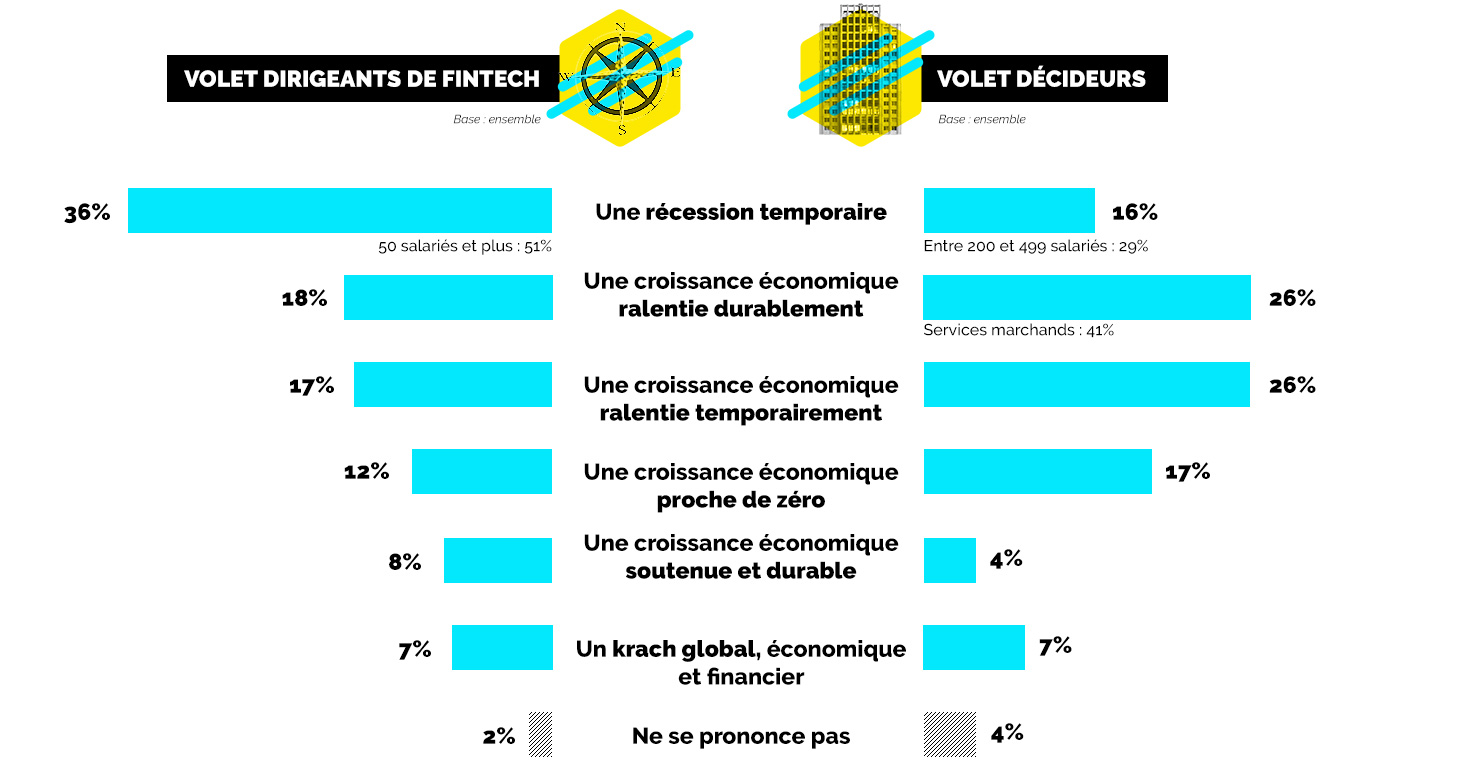

Finally, projecting themselves into economic scenarios over the next twelve months, fintech leaders anticipate for more than a third of them (36%) a temporary recession. This is followed by the item permanently (18%) or temporarily (17%) slowed growth. On the whole, fintech leaders thus mostly dismiss the prospects of sustained growth and a global economic crash, indicating their awareness of an economic context impacted by the economic situation but quick to offer new prospects (53% believing this scenario to be temporary). A vision shared by decision-makers who nevertheless favor slower economic growth than even a temporary recession.

Florian Moreau, Viavoice Consultant

THE RESULTS

Fintech leaders say they are overwhelmingly optimistic for the next 12 months, a higher and more marked score than decision-makers, who are more divided

For the next twelve months: regarding the economic situation of your company, are you…

Over the next twelve months, do you intend to invest…

Fintech leaders and decision-makers share the desire to invest more in human resources and technological development. An overall trend towards investment, however, less marked among decision-makers

Nearly two-thirds of fintech leaders want to invest more in marketing, communication, human resources or technological development in the coming months

Over the next twelve months, do you intend to invest…

OTHER INVESTMENTS

Investments in line with regulations / Developing partnerships, particularly with other fintechs / Investing in training / Investments in workspaces (premises and elements adjoining the premises)

If the decision-makers wish to invest more in human resources and green investments, they plan in priority to maintain their investments on the other registers

Over the next twelve months, would you say your company should invest…

OTHER INVESTMENTS

Investments in internal development (premises, infrastructure) / Investing in the transformation and reorganization of my business / Solidarity partnerships and in associations / In training

When planning to raise funds over the next twelve months, fintech executives and policymakers favor equity over debt

A majority of fintech executives and decision makers intend to hire over the next twelve months

Recruitment intentions among those who intend to recruit as initially planned, which appear to be linked in particular to the size of the structure

Fundraising and Recruitment Top Concerns for Fintech Leaders in the Year Ahead

The main reasons for confidence of fintech leaders are above all the development of demand and their ability to monetize it

More than a third of fintech executives believe a temporary recession is the most likely economic scenario, with policymakers eyeing slower growth more

Over the next twelve months, which economic scenario do you think is the most likely?

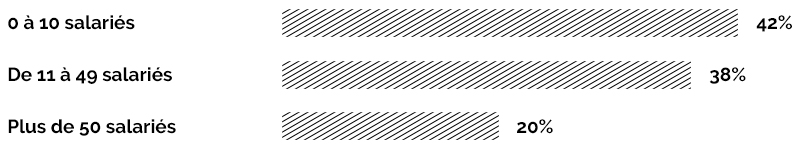

TECHNICAL NOTE

Fintech Leaders Stream

Consultation of all the leaders listed by France FinTech carried out online from September 8 to October 6, 2022.

In total, 311 managers were solicited by email and 84 questionnaires were collected. In addition to the initial mailing, three reminders were sent by France FinTech via personalized emails and a telephone reminder was made.

Overall return rate: 27%

Business Decision Makers Stream

Survey conducted online from September 9 to September 15, 2022.

Sample of 434 decision-makers representative of the population of private sector executives residing in metropolitan France.

Representativeness ensured by the quota method, applied to the following criteria: sex, age, profession, region

SAMPLE STRUCTURE

size of the company

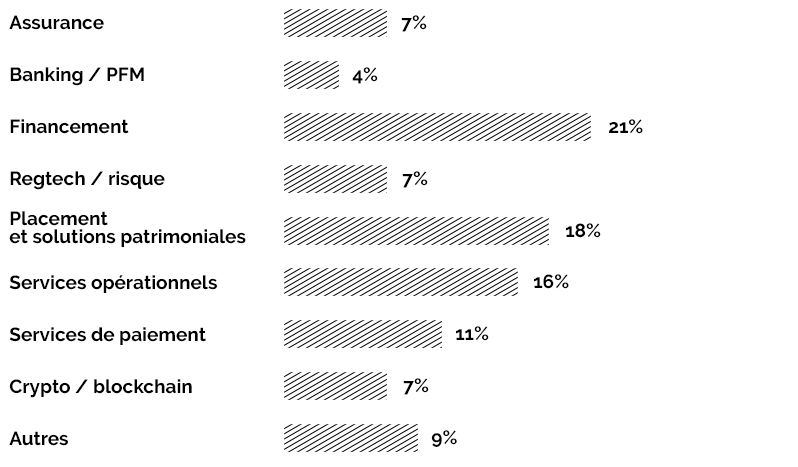

Fintech sector