French Fintech’s Frenzied 2020

« Fintech has become one of the most robust startup sectors across Europe, and France is no exception. The country’s entrepreneurs and political leaders have touted this as an area of enormous potential.

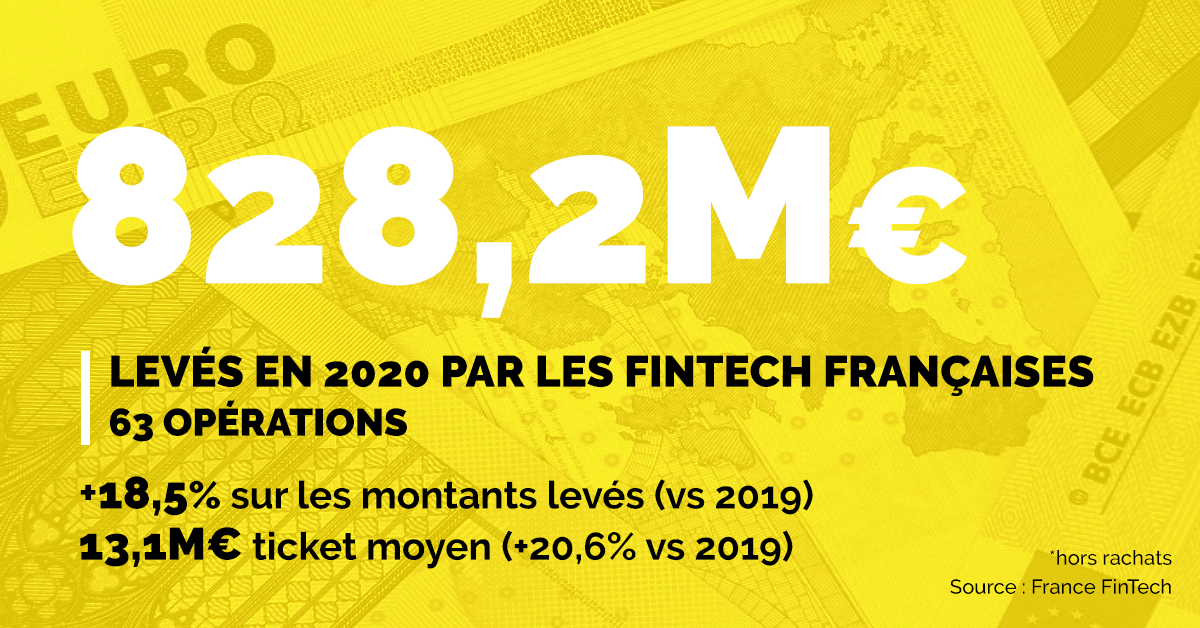

It seems investors agree. According to France FinTech, the professional association of Frances’s fintech companies (along with regtech and insurtech), fintech companies raised €828.2 million in 63 deals, up 18.5% from 2019.

The venture rounds driving those numbers, according to France FinTech included:

-

Qonto: This neo-bank for professionals raised €104 million in January. Investors included Tencent and DST Global, along with previous investors Valar, Alven, Taavet Hinrikus, and Ingo Uytdehaage.

-

Lydia: The company raised $131 million across a two-part round. Accel, the global fund, led the funding, along with previous investors China’s Tencent and XAnge.

-

Dataiku: This big data and AI startup raised $101 million in August. ICONIQ Capital led the investment which also included money from Alven Capital, Battery Ventures, Dawn Capital, and FirstMark Capital. (Side note: This seems like a stretch to claim as a fintech deal. Dataiku works across a wide range of sectors, including “retail, e-commerce, health care, finance, transportation, the public sector, manufacturing, pharmaceuticals.” Though Dawn Capital does focus on fintech, so 🤷.)

-

Luko: The home insurance startup raised $60 million in December. EQT Ventures led the round of funding along with previous investors Accel, Founders Fund, and Speedinvest.

-

Pigment: The data-driven financial decision-making tool raised €25.9 million in December. Blossom Capital led the round of funding, which also included FirstMark Capital and Frst. Angel investors such as Paul Melchiorre (former CEO of Anaplan) and David Clarke (former CTO of Workday) also participated.

Also noteworthy, in 2020 the average round increased 20.6% to €13.1 million, a trend that tracks across global venture capital as investors turned to established startups seeking later rounds during the pandemic. Having three rounds over €100 was also a bit of a milestone, along with a growing number of international investors.

As for France’s ongoing fintech ambitions, 2021 has already gotten off to a strong start. »

[…]