MINI SOCIOLOGY OF FINTECH FOUNDERS IN FRANCE

December 2021

A mini sociology of the founders of fintech in France

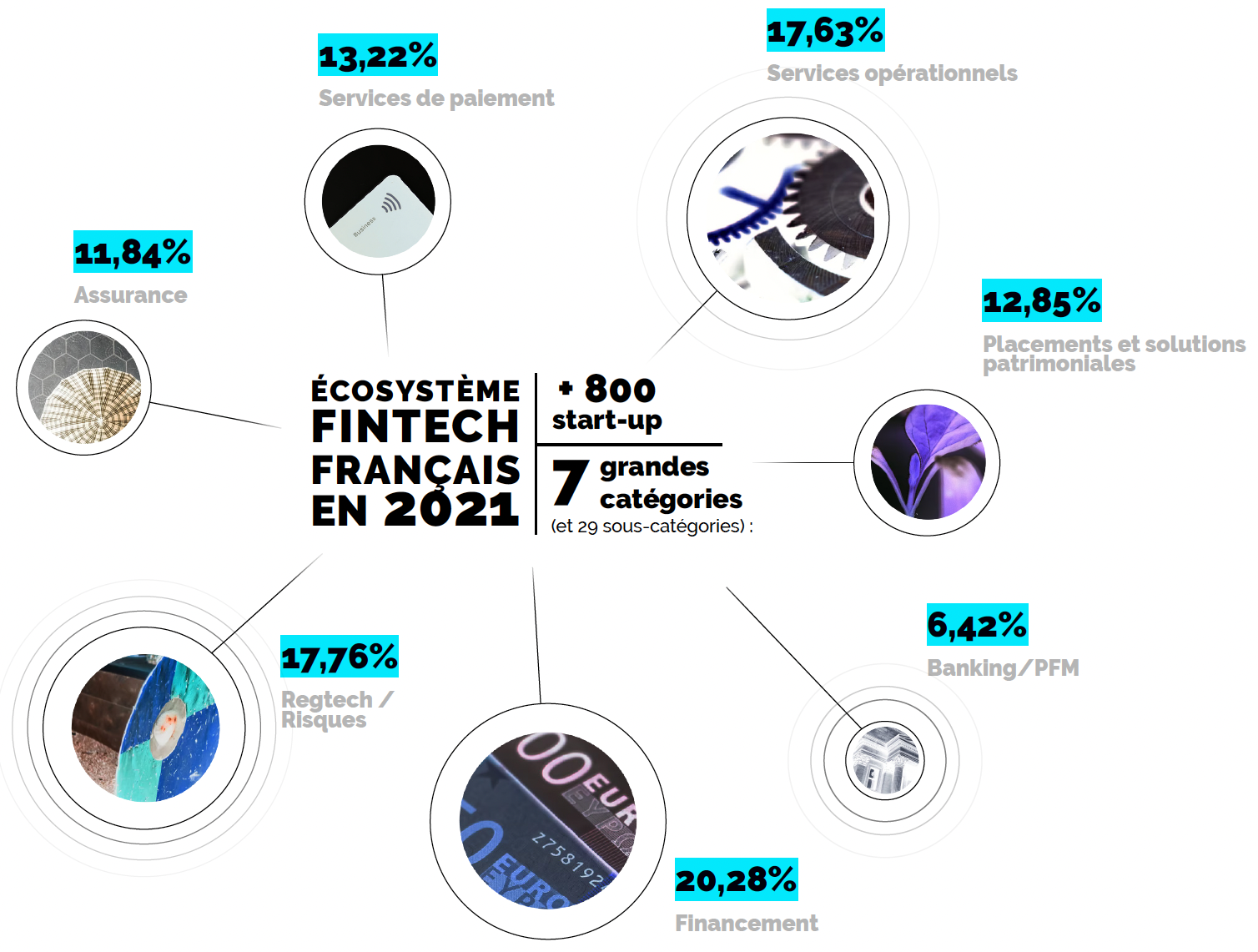

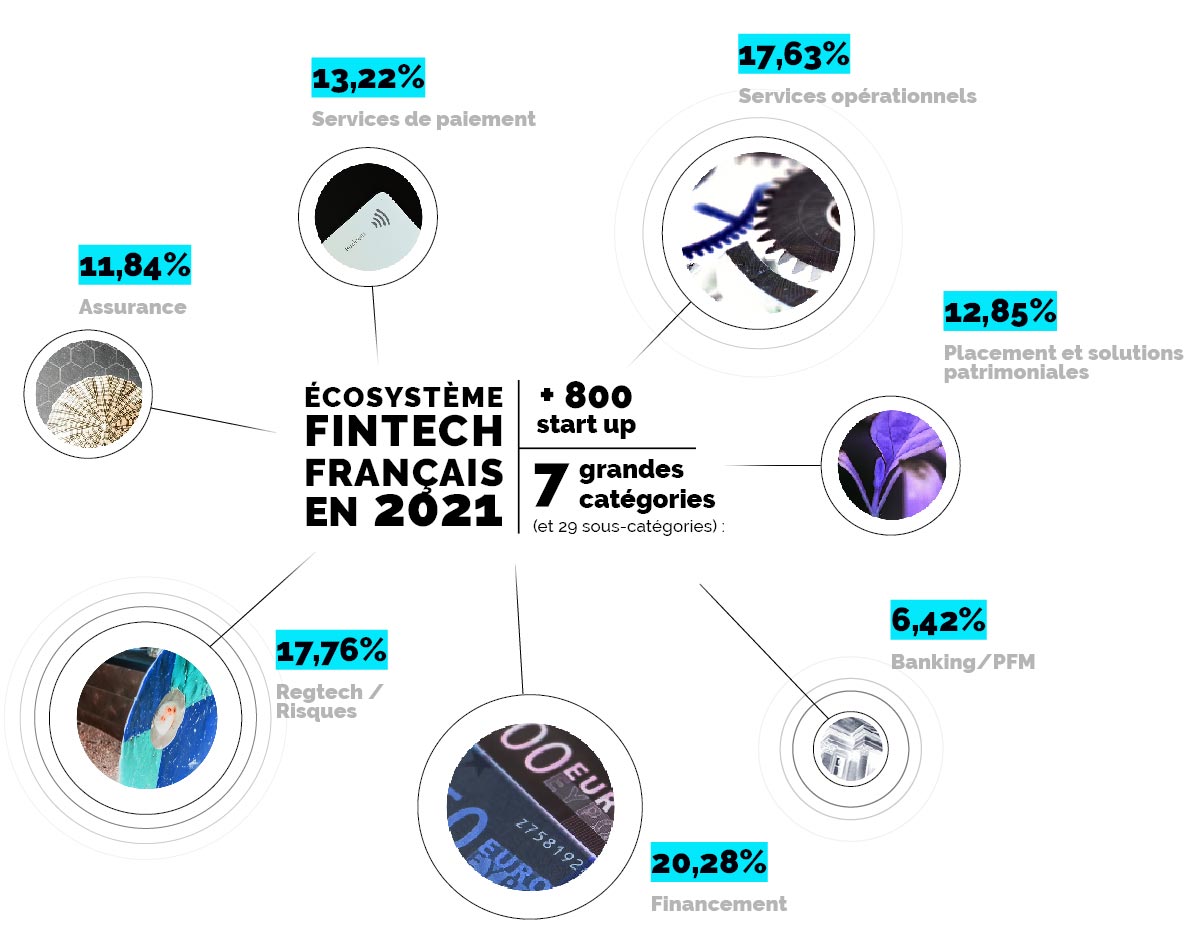

France FinTech and Blackfin Tech have published from 2016 to 2020 the annual fintech panorama of French fintechs, a reference mapping tool for the ecosystem. The two entities wanted to extend the process in 2021 and conduct an unprecedented study of the profile of the founders.

It was conducted between the second half of 2020 and the first half of 2021 on a representative sample made up of more than 200 fintech companies: French start-ups, start-ups and scale-ups in each of the 7 categories. The data processed and analyzed was supplemented by public information collected via LinkedIn and the press.

The study presents a number of original data, particularly on the origin of the founders.

It shows in particular that the founding exercise is most often collegial, that the creation of fintech right out of academic training, mostly higher education, is rare and that the majority of founders have experience acquired in a large company. .

¹ Sample compiled from France FinTech databases and public information.

It also highlights certain imbalances: the predominance of Grandes Ecoles graduates, the low percentage of women among founders and the over-representation of companies established in the Paris region.

Aware of the societal issues involved, France FinTech is committed to reducing these various imbalances through its many actions: carrying out a study on diversity (findings and areas for improvement), forthcoming publication of the barometer of diversity within of the ecosystem, support for regional platforms, intervention in schools and universities, creation of a sponsorship program for high school girls or even support for the Willa Women in Fintech program.

Certain favorable developments should also be highlighted: regular increase in the number of female founders, diversification of backgrounds and profiles of founders, or even acceleration of the establishment in the regions.

Synthetic :

70% of fintech founders are over 30 years old when they created their fintech and the majority already have at least one professional experience.

8% are over 50 years old.

5% fintechs were created during or after the studies of their founder(s).

The experience acquired was most often (82%) in a large company.

The most represented work experiences are auditing and consulting, technology and internet, banking and insurance, and retail.

A third of the founders in our sample had already created a company before.

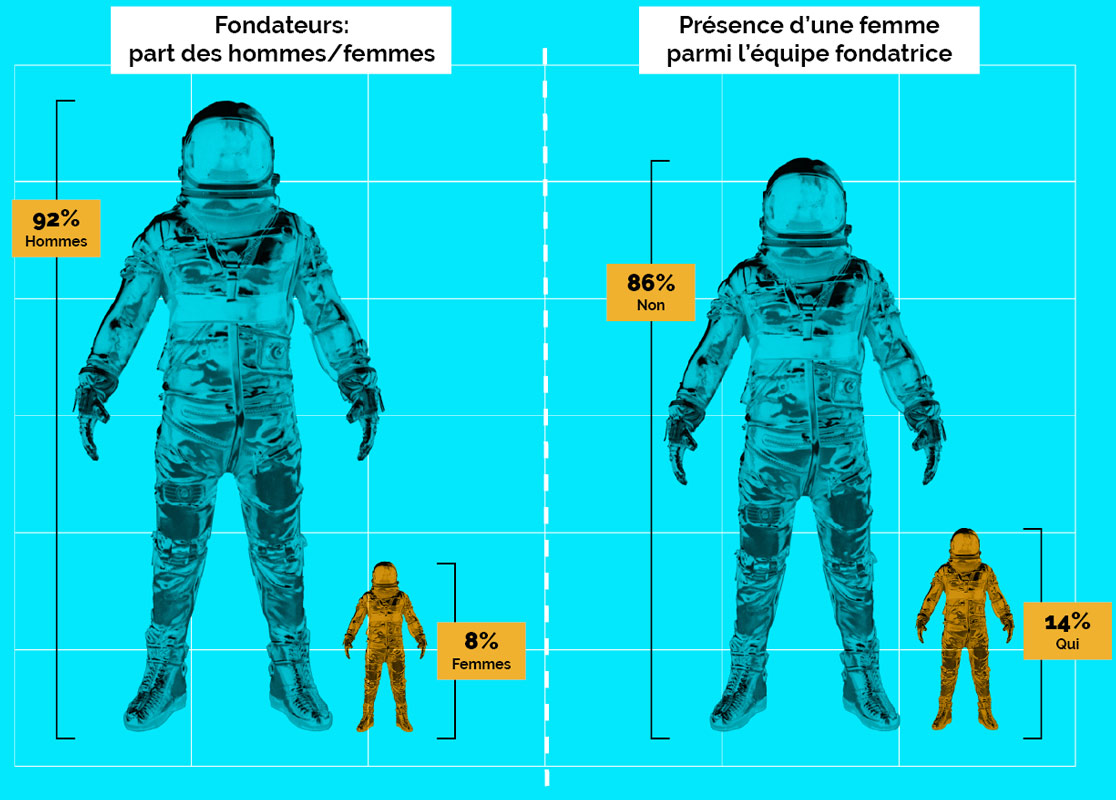

only 14% fintech have at least one founder and 8% of the founders are women.

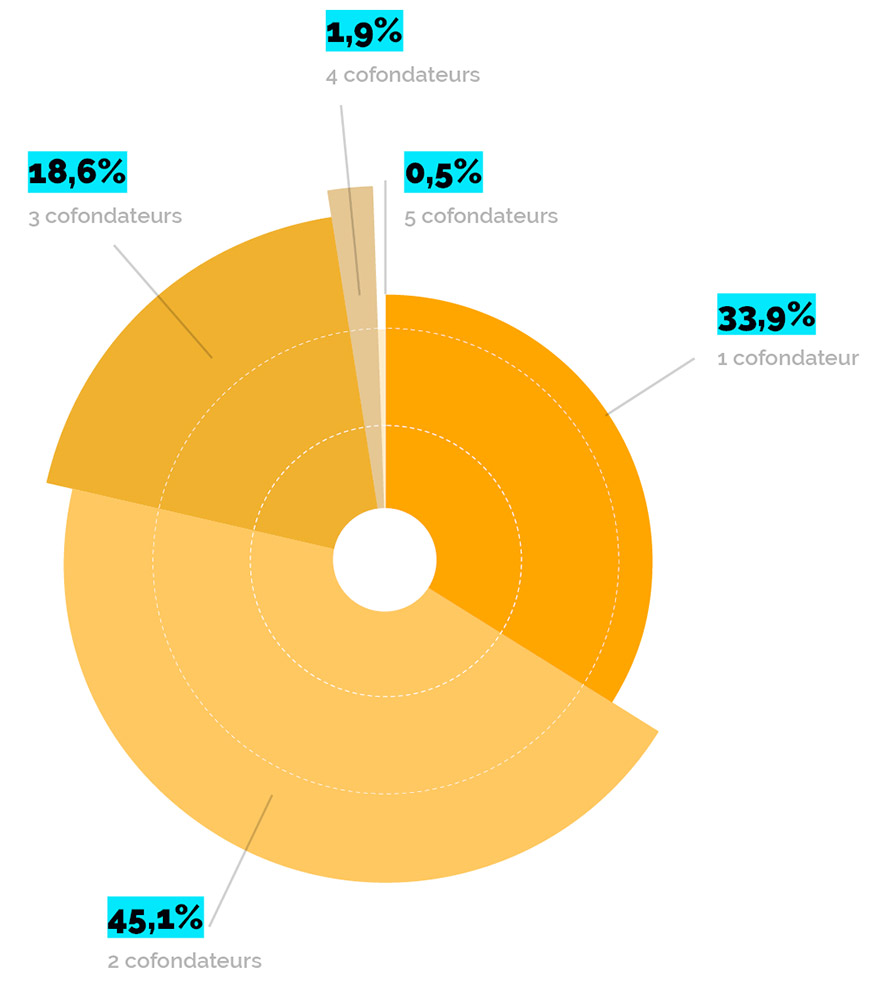

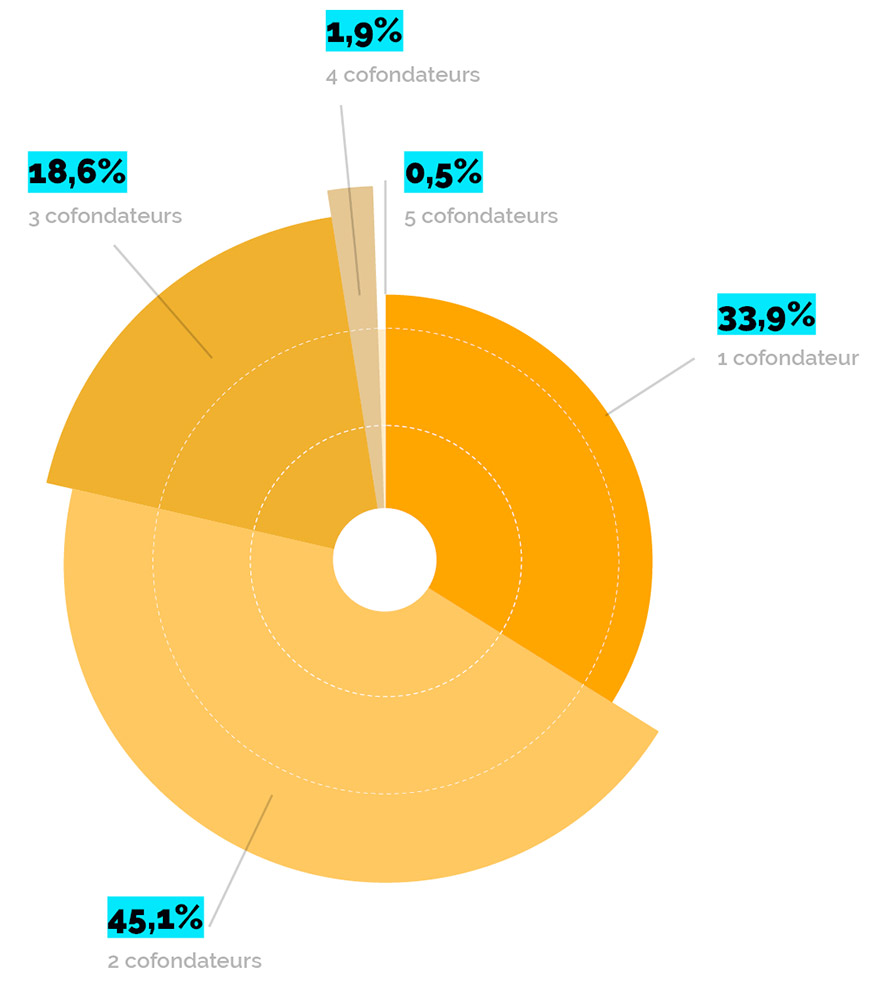

Two-thirds of fintechs are created by a group of founders; among them, almost half (45%) is founded by two people.

79% fintechs are established in Île-de-France.

1.

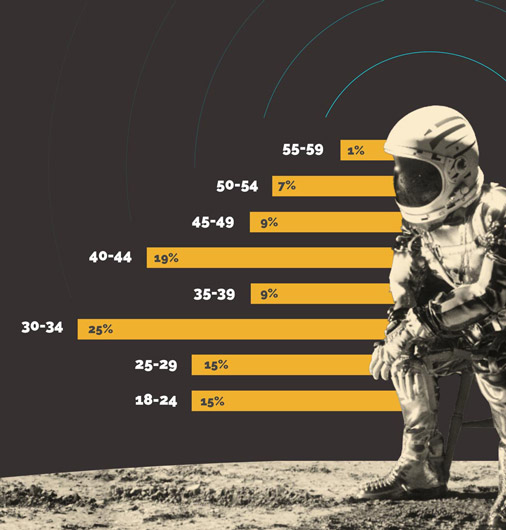

Age of founders

The majority of entrepreneurs created their company after one or more professional experiences.

- 70% of them are 30 years or older at the time of creation;

- The age group most represented in the act of creating a fintech is 30-34 years old (25%);

- 8% are over 50 years old;

- Seulement 5% of founders created their company during or after their academic training.

Age of founders at

creation of their start-up

2.

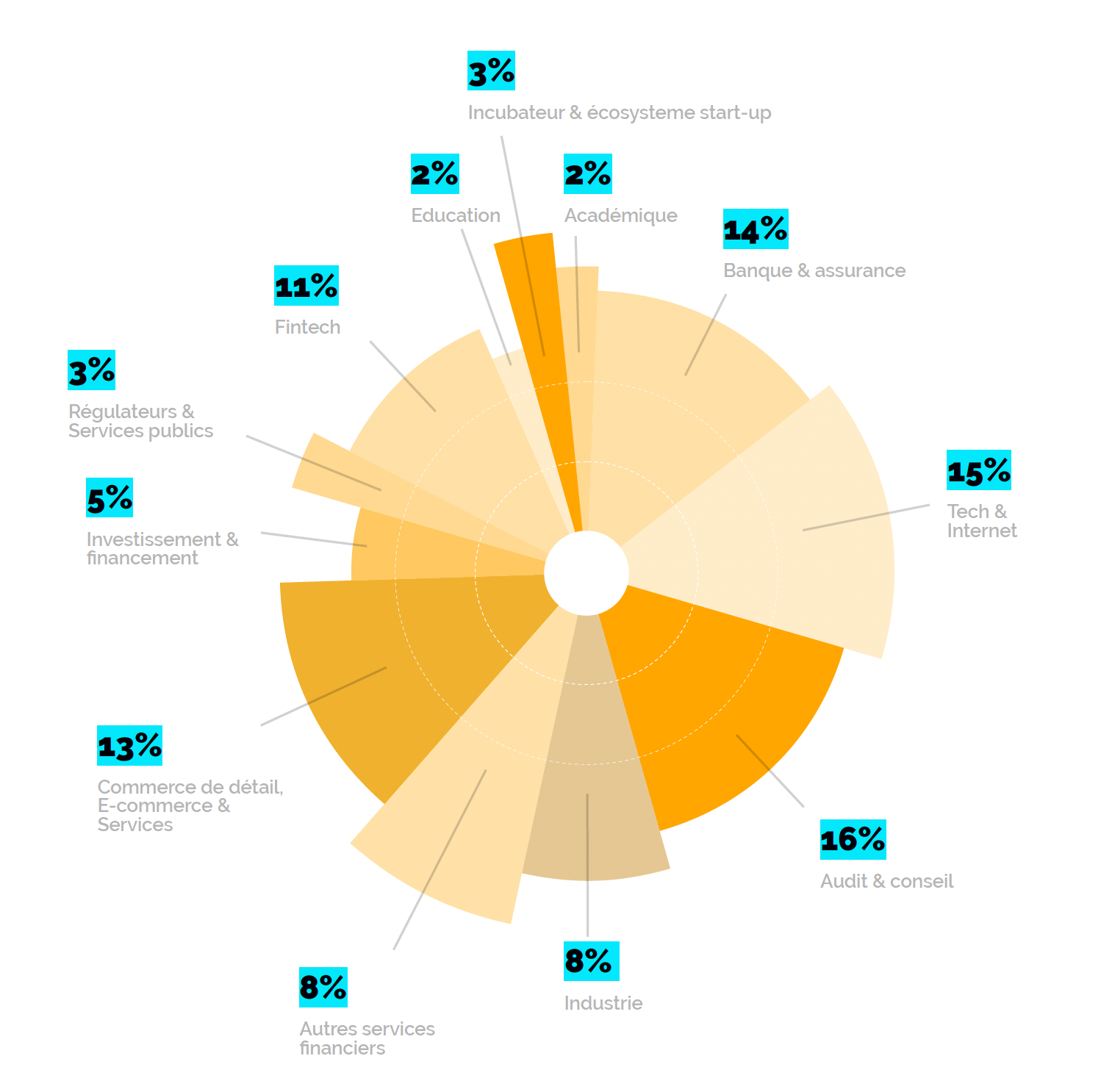

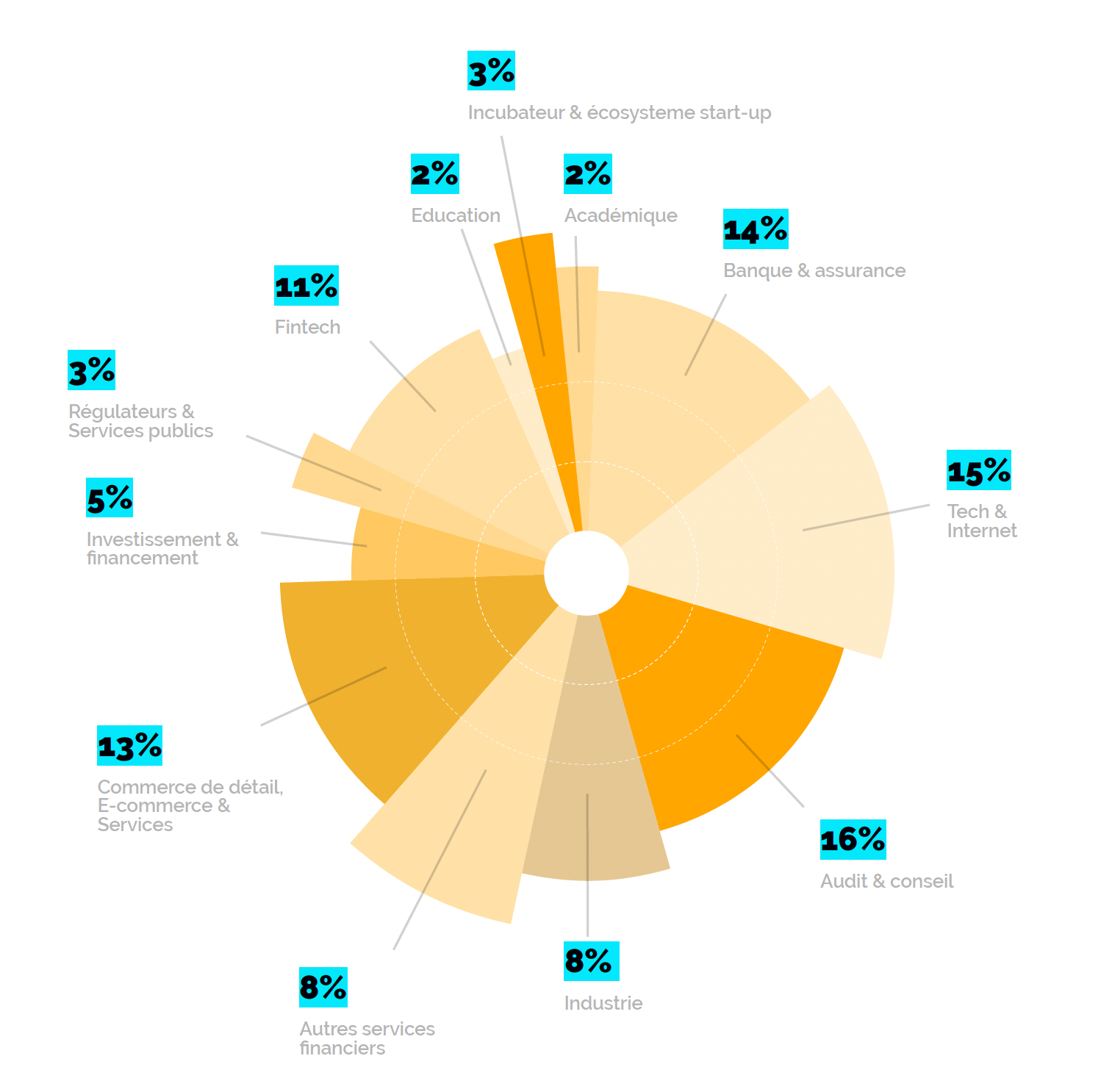

Career

The majority of business creators within the fintech ecosystem have experience acquired in a large company and a third have already founded at least one company.

82% of founders who already have professional experience have worked in a large company.

The sectoral origins are varied, however four areas stand out, almost at near parity:

– Audit and consulting (16%),

– Tech & Internet (15%),

– Banking & Insurance (14%),

– E-commerce and retail trade (13%).

Note that 11% of founders have already evolved in the fintech ecosystem.

A third of the members of our panel are familiar with entrepreneurship and have already founded one or more companies before.

3.

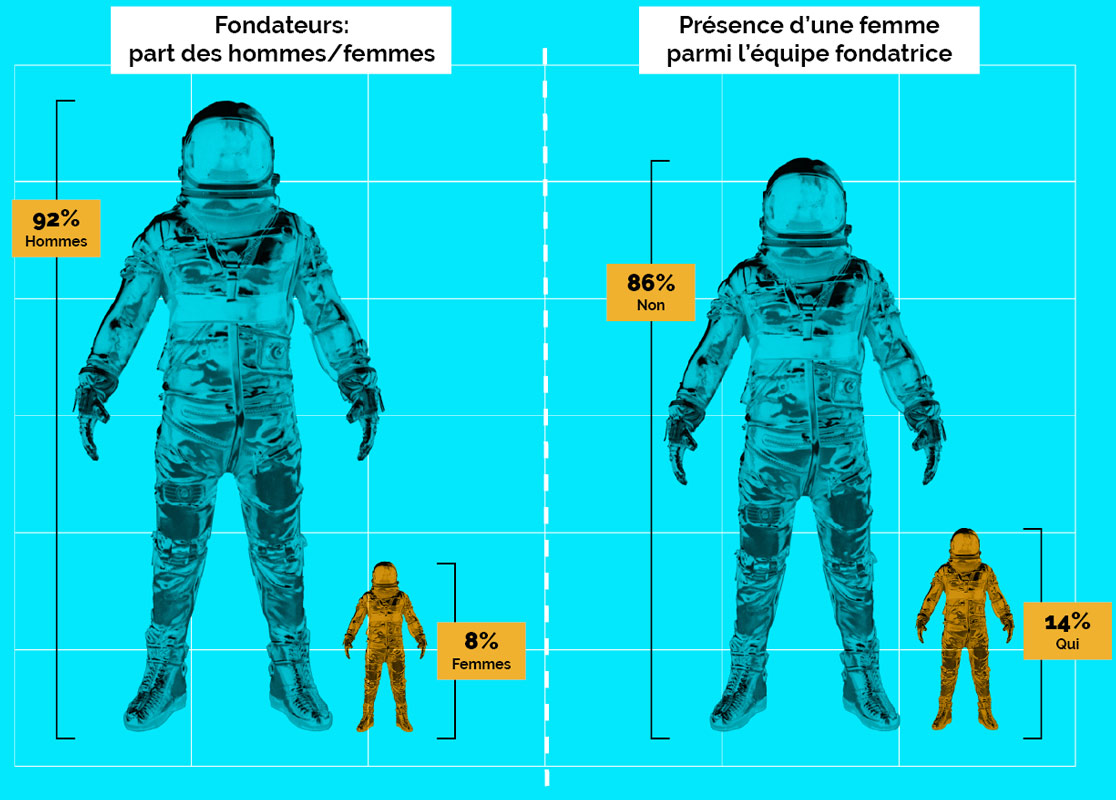

mix

Still too few foundresses!

- Women represent 37% of total fintech workforce (33% in 2019)².

- 14% of founding teams include at least one woman (12% in 2019).

- Of the entire population of founders in the sample studied, the proportion of women represents only 8%.

- The average amount raised by fintechs created by women is 2,5 M €.

² Source: Fintecher by France FinTech

4.

Collegiality of the founders

The vast majority of fintechs are founded by a team and not by a single person.

- 66% of fintechs are created by a team of founders.

- Among them, more than two-thirds have two co-founders at their head.

- 31% of co-founders have worked together before.

For memory

All sectors combined, 87%³ start-ups are created by several people and their partners have met⁴:

- within their professional environment (32%),

- during their studies23%),

- in the friendly circle (27%),

- in dedicated forums and lounges (15%),

- within their family3%).

³ ' ⁴ Source: Les Echos – Study carried out by Marion Flécher, doctoral student in sociology at Paris Dauphine

5.

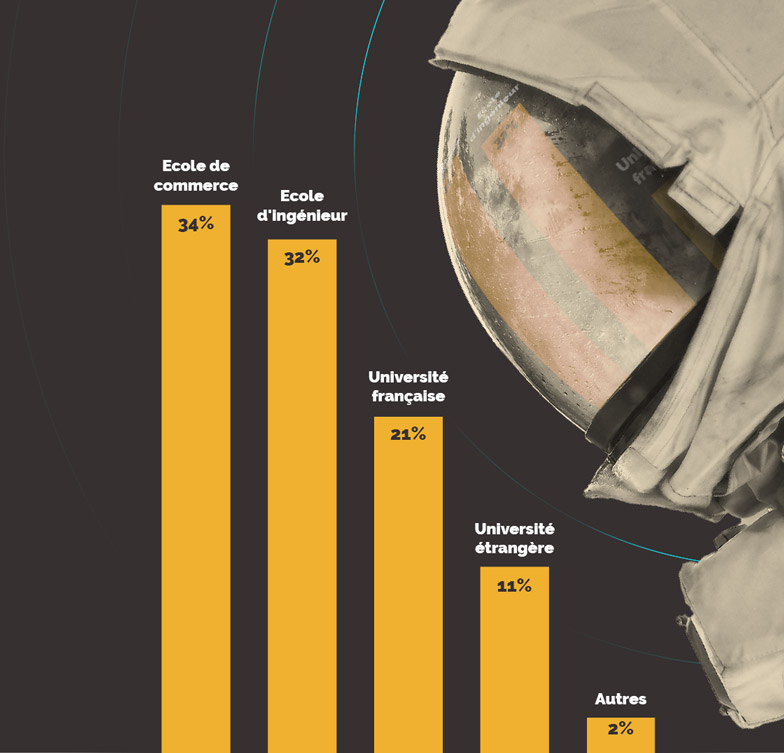

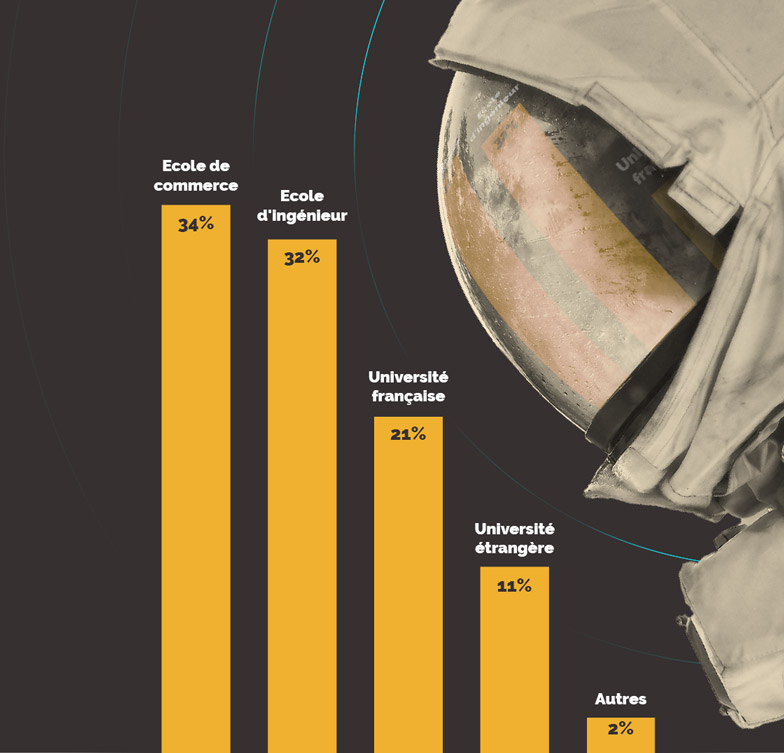

Academic experience

The majority of entrepreneurs come from a higher academic background ⁵.

Regarding our fintech sample:

- 66% of fintech founders in our sample come from a business or engineering school (as a reminder, the national average for all sectors is 54%⁶).

- Top trio of formations:

– CET (7%),

- Polytechnic university (4%),

– Paris-Dauphine University – PSL (4%). - More than one in 10 founders began their studies abroad.

⁵ Taking into account the initial training of the founders

⁶ Source: Les Echos – Study carried out by Marion Flécher, doctoral student in sociology at Paris Dauphine

Category of school whose founders are graduates

6.

Geography

Like the French financial sector, Paris and Île-de-France concentrate a large majority of fintech creations.

- 79% of entrepreneurs created their fintech in Île-de-France.

- Fintech establishments in the regions (outside Greater Paris) are growing.

Leading regions:

- Provence-Alpes-Côte d'Azur,

– Auvergne-Rhône-Alpes,

– Hauts de France.

As a reminder : 75% of investments in securities (56% of transactions) in French start-ups in 2020 were made in Île-de-France⁷.

⁷Source EY

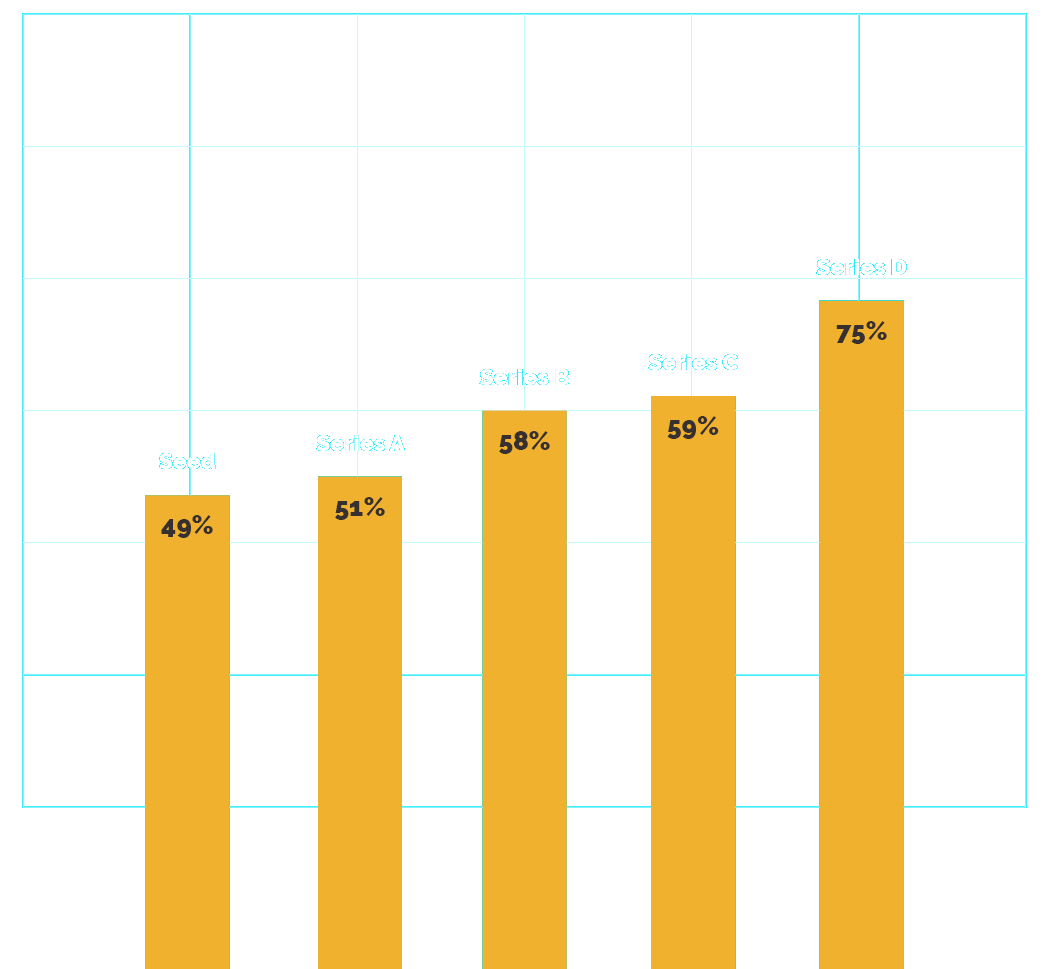

7.

Activities Funding

At least half of the fintechs that have raised funds have been founded by one or more entrepreneurs who have already created a company.

Percentage of founders who have already created a company by financing cycle

To go further in the knowledge of the ecosystem:

- Monthly barometers French fintech fundraising,

- Panorama 2021 French fintechs,

- Follow fintech news by subscribing to our newsletter,

- Discover their founders by listening EndTeach.