Top trends study

The TRENDING for the FINTECH French

In an uncertain environment, France FinTech and Roland Berger outline the fintech trends for the start of the 2023 school year.

2023

1.

Fintechs adapt to a stressed macroeconomic environment

2.

They confirm a positive development dynamic

3.

As valuations adjust, the seed is showing more resilience

4.

A change of context that puts certain segments under pressure…

5.

…especially neo-bank players

6.

A new market context favoring the acceleration of M&A operations

7.

Big Tech hasn't taken it all (yet)

8.

Impact fintechs are on a strong growth trajectory

9.

Despite a slowdown in recruitment, fintechs are a priori recording a positive net balance on employment

10.

Web 3 use cases are growing despite some resounding failures

11.

Financial Services embrace generative AI

1.

Fintechs adapt to a stressed macroeconomic environment

The current market situation (rate hike, inflation, uncertain macroeconomic and geopolitical outlook) and the maturing of the ecosystem have changed the “rules of the game”. Players are now moving from a hyper-growth model, largely fueled by access to abundant capital, to models that can demonstrate profitable revenue growth trajectories in the short and medium term (“controlled growth” trajectory). , with investors increasingly favoring the latter strategy.

This new ecosystem tends to favor the players best positioned on this trajectory: they can take advantage of this context to consolidate the market.

Fintechs operate and adopt several measures to converge on these winning models:

- Refocusing the activity on the core business on product and/or customer dimensions;

- Geographical refocusing, with an end to the race to internationalize at all costs to focus on their key markets;

- Adaptation and adjustment of the payroll Consequently.

2.

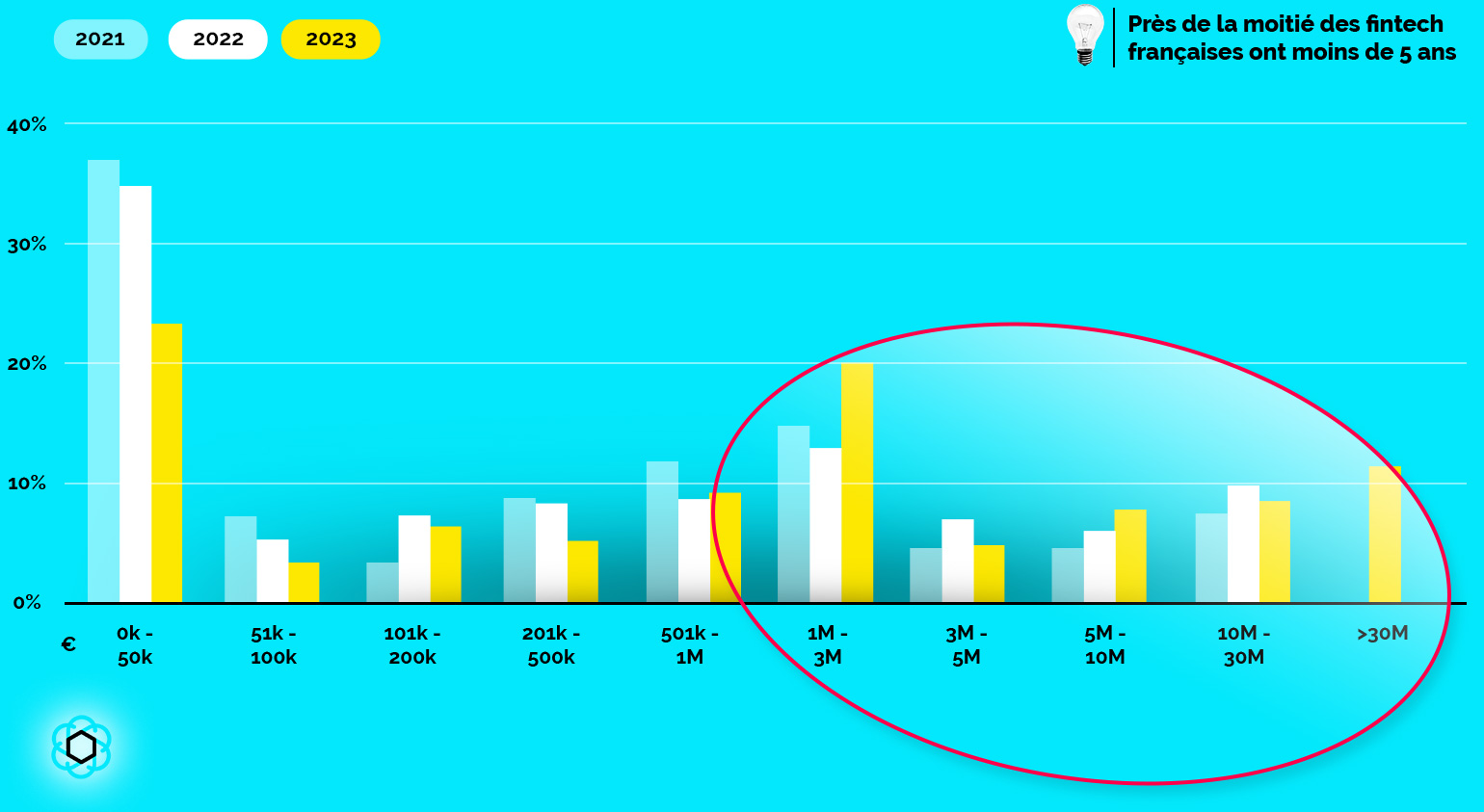

They confirm a positive dynamic of development

Despite this uncertain economic context, fintechs have confirmed their positive momentum in 2023: 52,4% of fintechs already generate more than €XNUMX million in turnover compared to nearly 36% of fintech in 2022 and 32% in 2021.

This development confirms the strengths of the players:

- A suitability of products with customer expectations;

- A digitalization of the economy which continues;

- Personalized proven business models confirming the potential for a profitable monetization trajectory;

Personalized partnerships “at scale” intra-fintech or with institutional players

More than 52% of French fintech companies achieve a turnover of more than €1 million in 2023 compared to 50% in 2022.

3.

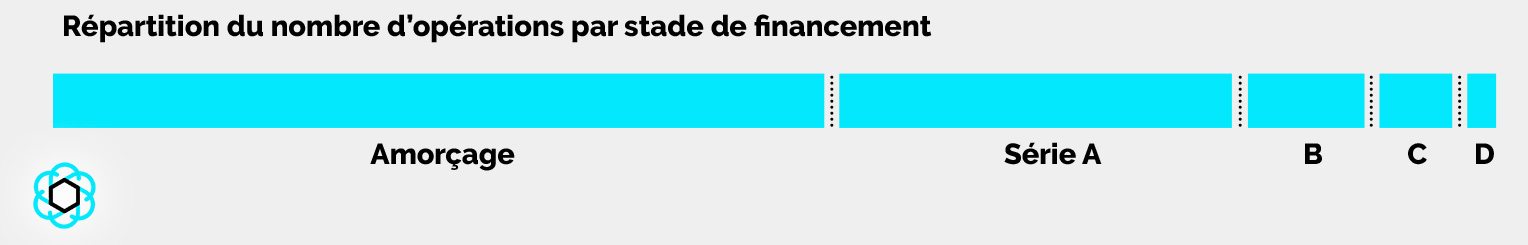

As valuations adjust, the seed is showing more resilience

The rise in interest rates has resulted in a scarcity of capital and therefore an adjustment in fintech valuations, demonstrating the potential maturity of the ecosystem.

Investment files have thus become more complex in recent months: faced with this scarcity of capital, investors are more demanding, which has the effect of lengthening the time it takes to access financing.

Seed financing volumes were globally divided by 3, going from €503,6m raised in June 2022 to €174,4m raised in June 2023. Nevertheless, the number of operations remains significant (decrease from 67 to 49 operations, ie – 27% of operations on a like-for-like basis).

The relative resilience of the number of seed operations illustrates the growing involvement of “enlightened” investors: more and more business angels very familiar with the fintech ecosystem, being themselves former fintech founders, are in turn reinvesting in the sector.

Analysis of 2023 fundraising

4.

A change of context that puts certain segments under pressure…

The inflationary context (+4,3% over one year¹) and rising rates (4,25%² in August 2023) has a direct impact on the business model of financial services in general and fintech in particular:

- Models based on a rate spread find themselves constrained by a “scissors effect” between the cost of the resource and the client pricing;

- Inflation has a strong impact on household budgets and can lead to an increase in the cost of risk for players exposed to credit at large;

- In addition, models with high customer acquisition costs are also constrained by more complicated access to financing.

To cope with this new paradigm, these actors must quickly adapt their modelsIncluding:

- By integrating into a larger part of the value chain rather than positioning itself as an intermediary on the whole ecosystem (eg end of “super application” trajectories)…

- Considering getting a credit approval as one of the key links to create value

1. Annual change in inflation in France in July 2023, source: INSEE

2. European Central Bank key rate for main refinancing operations, source: Banque de France as of August 02, 2023

5.

…especially neo-bank players

The question of adapting models is all the more significant in so-called neo-banking models. which remains a heterogeneous segment in terms of the type of customer targeted, breadth of offer, international ambition and economic and operational model.

The credit variable remains discriminating and therefore a strategic question for these actors:

- The initial strategy of neo banks with an international scope was apply for a credit institution license; today several players have at least temporarily given up on it.

- This trend is mainly due to the length of the accreditation process, the associated cost (equity) and the facility offered by players specialized in “Open Finance”

However, the credit component, which generates profitability, customer knowledge and retention, remains strategically essential; most players therefore seek to acquire it either organically or through partnerships (e.g. financing offer in partnership with approved players)

6.

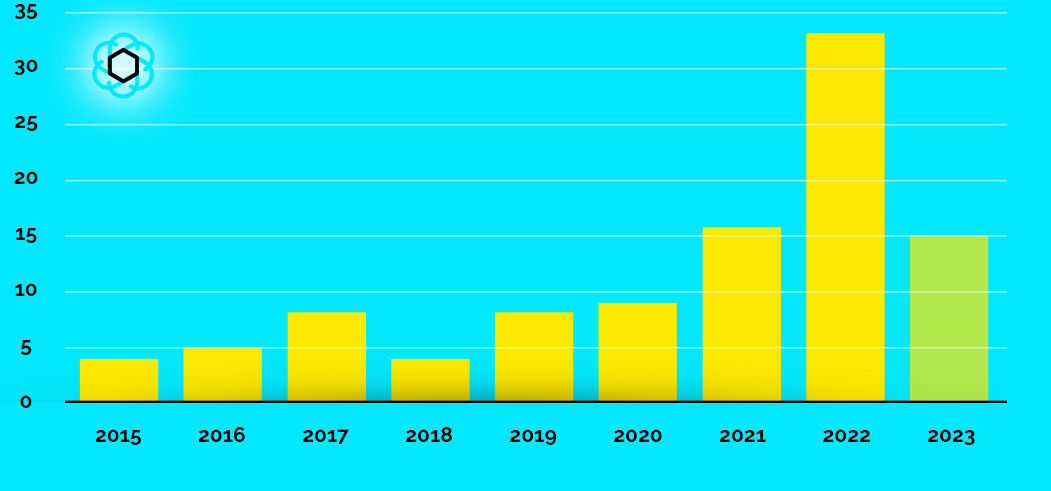

The new market environment favors the acceleration of M&A operations

Mergers and acquisitions transactions, 15 in number since the start of 2023 (compared to 33 in total in 2022 and 16 in 2021), concern in 40% of cases, operations between fintech.

Cross-border activity is sustained since 9 foreign fintechs have been acquired by French companies and 5 French companies purchased by foreigners.

These operations respond to both strategic moves, aimed in particular at develop in new countries, save time in acquiring critical size, develop new businesses, only taking opportunities. In fact, the fall in valuations and the cash or model impasse in which certain players have found themselves, paving the way for mergers. In this last hypothesis, the operation frequently takes the form of the purchase of assets.

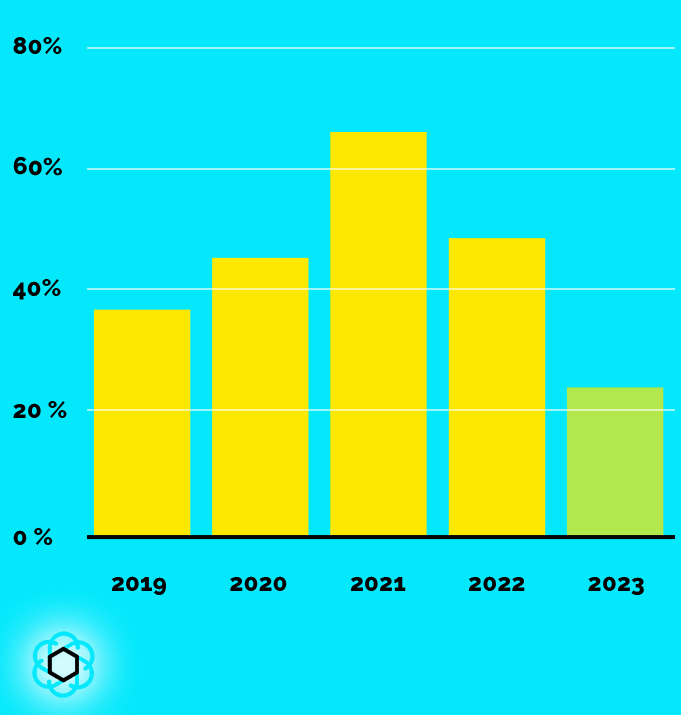

Evolution of the number of M&A transactions³

Annual evolution between 2015 and 2022, and from January 1 to July 30 for the year 2023

In the new market context, opportunistic M&A exists but must be considered with great caution. The constitution of a real internal competence not only for the deal making but also for the integration remains the only guarantee of an M&A strongly creating value.

Eric Mignot, Founder and President, +Simple

7.

Big Tech hasn't taken it all (yet)

Big Tech players have launched numerous Financial Services initiatives, particularly in the United States, first in payments before extending to credit, savings or even crypto.

These initiatives have had varied fates (including the most promising), which can be explained in particular by:

- Distrust of these actors who are not perceived as trusted third parties

- A lack of expertise among players in the field of financial services, despite an undeniable technological contribution

Even if GAFAM's offers remain limited today in terms of breadth of range and market depth (beyond payments), they demonstrate a real desire on the part of these players to familiarize themselves with the market.

Observers are therefore awaiting the breakthrough of these players on the Financial Services market, and in particular on the European market, with ambitious offers in banking and insurance likely to reshape the existing landscape.

Today, only Apple has established itself in Europe with Apple Pay and could accelerate by replicating the features and offers available in other markets such as Apple Pay Later or Apple Card.

8.

Impact fintechs are on a strong growth trajectory

Impact fintechs contribute to environmental and societal transformation. The impact today represents a double challenge for fintechs:

- On the one hand, great opportunities lie in they integrate this notion in its own right into their model in order to become exemplary companies in the eyes of their customers, their investors and their employees, ever more concerned about their environmental and societal impacts:

- On the other hand, fintechs dedicated to emerging impact more on the market, whether at the service of individuals (e.g. sustainable payment, green savings / responsible investment), corporate clients (e.g. ESG measurement of the asset portfolio), or as a technological brick for other companies (B2B2C)

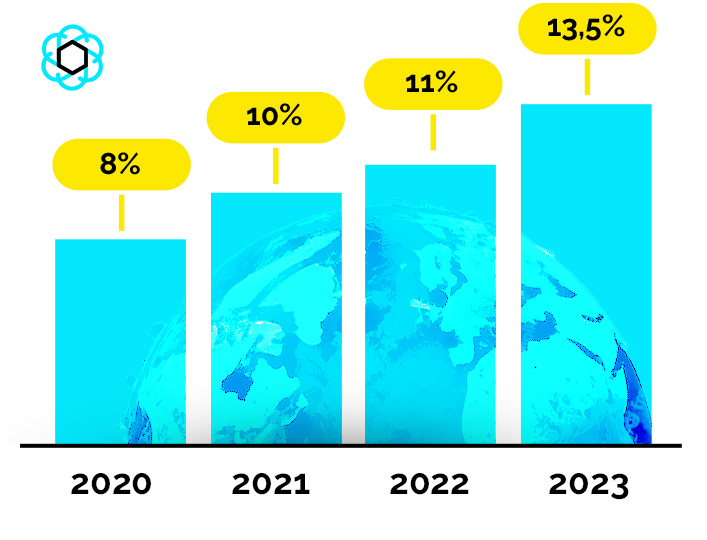

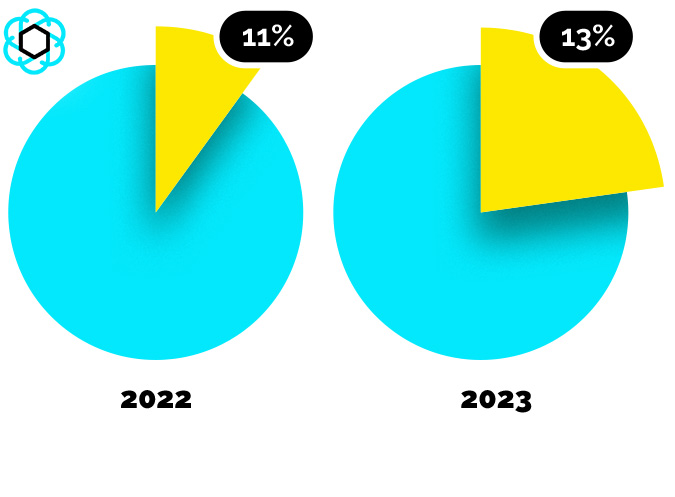

Impact fintech continues to grow:

- Among the 900 actors identified in France, impact fintech will represent 13% of the ecosystem in 2023 (only 8% of the ecosystem in 2020).

- The impact fintech sector is a significant recruitment pool with more than 5000 jobs created in France at the start of 2023, and a very strong recruitment forecast by the end of 2024. (+79%)

In a context of slowdown, impact fintechs raised €87,1 million in 17 operations to July 2023. Despite a drop in the average amount raised compared to the same period in 2022, the number of operations is stable.

Evolution of the number of fintech with impact in France

9.

Despite a slowdown and some downsizing operations, fintechs are a priori recording a positive net balance of job creation.

The economic context has forced a number of players to adjust quickly to a new market situation in particular by adjusting their payroll accordingly.

Despite a slowdown and certain headcount reduction operations, recruitment nevertheless continued to meet the growth challenges of the players. with probably a stronger focus on revenue and monetization oriented profiles.

According to our initial estimates, the balance of job creation seems to be positive in the first half, with persistent tension on certain types of profiles (eg IT developers, marketing).

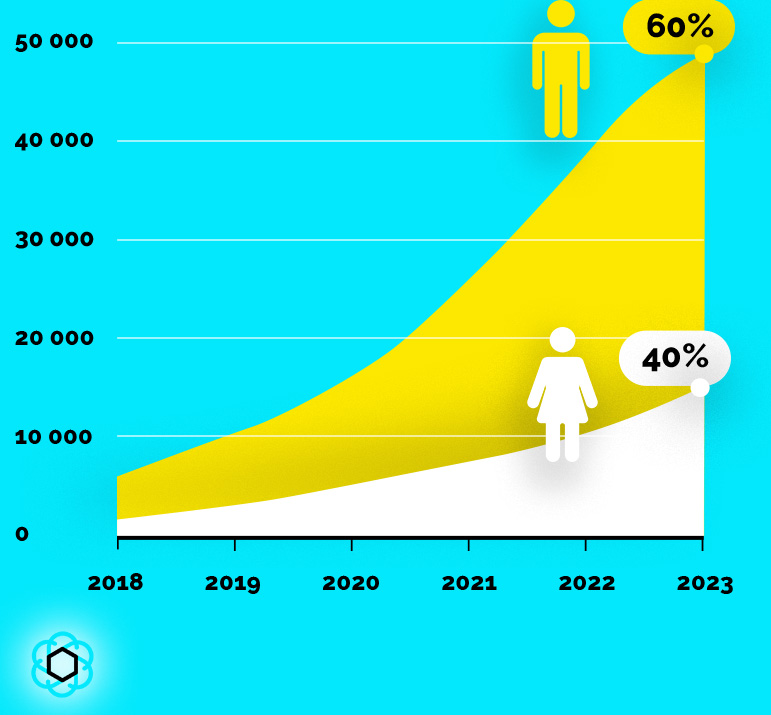

The fintech sector remains an important recruitment pool with +40,000 jobs already created in France by fintech at the end of 2022.

Parity remains an essential area of progress for fintechs: despite notable progress (37% of female recruitments in 2022 vs 35% in 2021), there is still a significant gap to fill.

Direct jobs created by French fintechs

40% female recruitment in 2023 vs 37% female recruitment in 2022 vs 35% in 2021

Recruitment growth per year

In 2023, recruitment should continue by +23%, at a slower pace than in previous years.

10.

Web 3 use cases are growing despite some resounding failures

Beyond the failures of certain players observed recently and the overall consequences observed on the market, the use cases of crypto, blockchain and tokenization are developing in the fields of financing, payment and loyalty.

The development of the regulatory dimension of the sector (e.g. European regulation MiCA – Markets in Crypto Asset) should help to reassure the various players in the ecosystem and to better distinguish between technological contribution and new uses vs. speculative investments.

France also plays a leading role in the development of the global ecosystem. Several global players have established their headquarters in Paris (eg Binance, Crypto.com, Circle) to develop their European activities. These players choose France for several reasons:

- The establishment of clear legislation for players, through the creation of a regulatory framework conducive to the development of the industry (PSAN approval – Digital Asset Services Provider)

- The role of France as a leader in defining European regulations for cryptos.

- The presence of a developed pool of technological talents and talents in regulatory compliance in France.

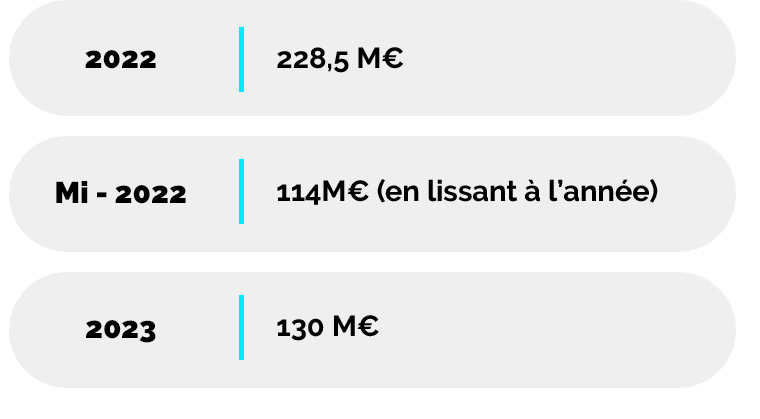

Share of crypto fintech players raised in the total amount raised by fintechs

In 2023, crypto fintech players raised €130m (i.e. +14% compared to the smoothed average over 6 months of 2022)

11.

Financial services embrace generative AI

The first wave of innovation in financial services relied less on technological innovations than on new uses (pools, payment, peer-to-peer, crowdfunding, etc.) and careful work on the customer journey.

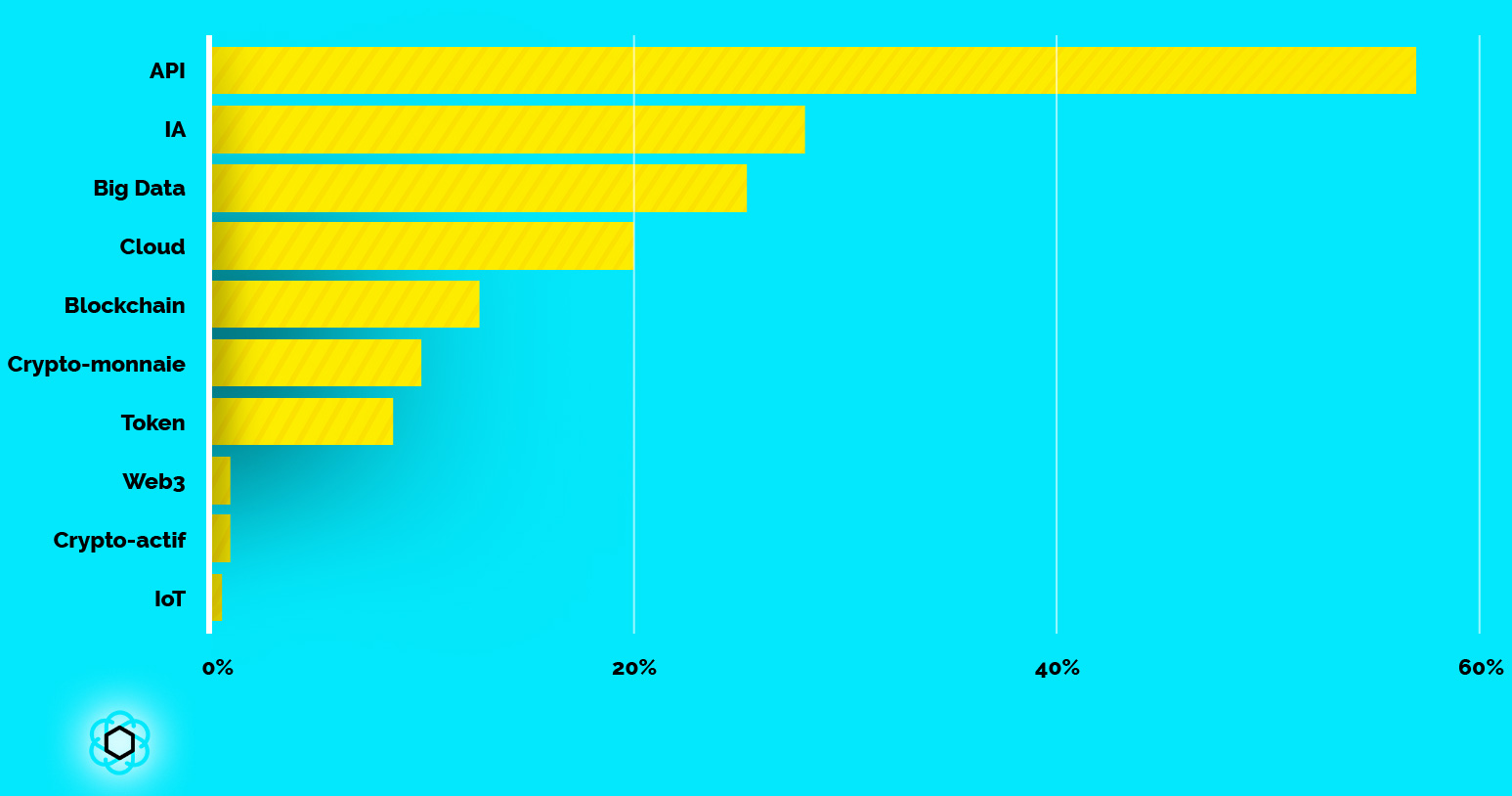

Today, Tech is positioning itself in a driving role given the potential of the blockchain and in particular of AI, although it already occupies a prominent place in innovative finance models, with 30% of French fintechs already using AI.

The potential of generative AI today is considerable, with a contribution of new use cases which should concern:

- The relationshipn customer, via the optimisation of customer interactions through bots, chatbots, etc.

- Risks, through the identification, analysis, management and rating of these

- Productivity (e.g. customer acquisition, targeting, operating costs)

These three dimensions are essentially at the heart of the models of banks and insurers, which suggests a major impact for the entire financial ecosystem, whether traditional or innovative.

Use by French fintechs of technological functionalities

To go further in the knowledge of the ecosystem:

- Monthly barometers French fintech fundraising,

- Panorama 2022 French fintechs,

- Follow fintech news by subscribing to our newsletter,

- Discover their founders by listening EndTeach.

Roland Berger Contributors:

Chafik Alaoui

Christian Heinis

France FinTech contributors:

Alain Clot

Kristen charvin

Louis DeSaint-Marc

Tatiana Ramaroson

About France FinTech:

Created in 2015 on the initiative of entrepreneurs, France FinTech brings together companies using innovative and disruptive operational, technological or economic models aimed at addressing existing or emerging issues in the financial services industry and representing the main components of the sector. The association's mission is to promote excellence in the sector in France and abroad and to represent French fintechs to public authorities, the regulator and the ecosystem. France FinTech is today the largest sectoral association of start-ups in France and in Europe. In addition to its actions in regulatory and legislative fields, its numerous publications, its workshops and various meetings, the association organizes each year the benchmark event of the ecosystem, Fintech R: Evolution. France FinTech is a founding member of theEDFA (European Digital Finance Association).

About Roland Berger:

Founded in 1967, Roland Berger is the first general management consultancy firm of European origin and with international roots. Established in France since 1990, the Paris office with nearly 300 employees advises the largest international companies as well as public institutions, on all of their issues, from strategic advice to operational implementation. With the conviction that the world needs a new sustainable paradigm across the entire business value chain, he is committed to offering innovative solutions, with particular attention paid to obtaining concrete and measurable results.

For more information : https://www.rolandberger.com/fr/

Follow Roland Berger on twitter: @RolandBerger