SUSTAINABLE FINTECH PANORAMA 2023

Convinced that innovative finance players can be driving forces in the transition and support sustainable development objectives, France FinTech (FFT) and the Institute of Sustainable Finance (IFD) have joined forces to produce the first edition of their joint overview sustainable French fintechs.

In view of the growing number of innovative finance players whose model is centered on sustainable development issues, the joint work of the two organizations takes on its full meaning. The objective of this publication is to reference, promote and support the approach and activities of these fintechs.

The two entities are continuing their work¹ and the numerous interventions given to promote sustainable fintech initiatives and models, and contribute to raising awareness of environmental, social and governance (ESG) issues within the financial sector.

France FinTech, as a professional association of French fintechs, and the IFD, by coordinating the action of the Paris financial center for the achievement of the energy and environmental transition, thus provide a structured vision of the ecosystem which will make it possible to follow the evolution of the sector, to characterize the typologies of solutions, the trends of different activities but also to detect the obstacles to their development, particularly in terms of definition, criteria, assessment and regulation.

¹ See:

France FinTech x Julhiet Sterwen | White Book The impact in financial services

France FinTech x Crédit Mutuel Arkéa | Infographic of impactful fintech

Institute of Sustainable Finance x ADEME | Panorama 2022 of French sustainable fintechs

All companies have a positive role to play in ecological and societal transitions. CSR is a top priority. For Julhiet Sterwen, this is reflected in particular by our historic Consulting for Good commitment, taking pleasure, on a daily basis, in doing things for the good of our stakeholders. The white paper for which we partnered with France Fintech, in 2022, is fully in line with this approach. We then wondered how impactful fintech could inspire more traditional players in the world of banking.

The panorama that you can see today, if it has its roots in this dynamic, goes even further. It brings together fintech companies that have made the founding choice of sustainability. Economic models are built to have a societal and environmental impact that is no longer simply positive but to resolve particularly acute problems. They show us the way, aware that they are of the urgency of addressing certain subjects, from supporting the most vulnerable populations to global warming. They are powerfully inspiring for major players in financial services, showing that another path is possible.

Concretely, for traditional players, this implies an authentic paradigm shift. It is a return to the founding role of the company, a committed player in Society, and therefore to its responsibility. It means adopting a new way of thinking, based on the social/societal, environmental, governance/economic triptych. It means developing strategies, policies and actions with a vision combining the perception of emergencies to be met and long-term impacts. It means accepting that we cannot do everything in the name of financial profitability and even less short-term profitability. And realize that by prioritizing people and the environment, we do not necessarily go against financial success, quite the contrary.

Hurry up. Let’s transform our approaches. NOW.

ADEME's support for the Fintech Challenge since its creation is part of our action to support research, development and innovation. The challenge for us is to highlight and provide support to start-ups and innovative digital solution projects that will facilitate the financing of the ecological transition.

Achieving the transition obviously requires planning on the part of public actors with a roadmap given by the National Low Carbon Strategy as well as private actors whom we support in their diagnosis (GHG Balance Sheet) and their transition plans (ACT). However, we pay particular attention to innovations and weak signals that can make it possible to rethink economic models to bring about more sustainable, resilient, just and inclusive models.

This agility of fintech to propose and test new solutions makes it a key area to observe in order to support the best ideas. Thus, the panorama of sustainable fintech gives us the maps to understand the issues covered and know the abundance of initiatives. It is also the visualization of an ecosystem with which we regularly interact in order to share our expertise on the issues of decarbonization, thanks to events organized by the Institute of Sustainable Finance.

Companies operating in the field of financial technologies (fintech) having submitted their application and benefiting from a favorable opinion from the two associative entities have been selected to appear in this first joint panorama.

The selection of companies was carried out using a series of previously defined eligibility and distinction criteria, with the support of competent experts in the field, as follows:

- A significant contribution to the financial industry;

- An innovative character linked to:

-

- the technology used,

- use, through the change introduced by the use of the product or the consumption of the service according to needs;

-

- A contribution to a sustainable development issue focused on one of the following pillars:

-

- Environmental,

- Social,

- Governance.

-

In addition to the eligibility criteria, additional criteria made it possible to ensure a relevant selection:

- Head office based in France

- Registered company whose product is operational

- Company that has not completed an exit (no buyout or IPO)

- Consulting companies or design offices were excluded.

It should be noted that the evaluation of the contribution to a sustainable development issue is largely based on elements publicly accessible or communicated by the company. These elements include in particular the intensity of the intentionality manifested in the communications, the detailed description of the products and/or services offered by the solution, as well as the possible presentation of certifications, labels or specific statuses. It should be emphasized that this criterion can only be examined in depth through communication and tangible attributes. However, it is obvious that communication alone cannot be sufficient to irrefutably demonstrate the true contribution to the Sustainable Development Goals.

As a result, some companies that submitted their application via the form were not included in this overview. It should be noted that this exclusion cannot call into question the inherent value of their initiatives, but simply reflects the choices made within the framework of this publication.

We invite you to carefully browse the sustainable fintech landscape, keeping in mind that this first publication constitutes a representative snapshot of the current landscape.

Details on the selection criteria

Mission-driven companies

The legal status of a company with a mission, introduced by the Pacte law, consists of a company publicly affirming its reason for being as well as one or more social and environmental objectives that it sets itself the mission of pursuing within the framework of its activity. This quality, as well as certifications, other statuses and labels, such as the B Corp label, awarded to companies meeting rigorous standards in terms of social and environmental performance, were taken into account to assess their commitment to social and environmental objectives. specific environmental conditions. Regarding mission-based companies, it remains important to emphasize that not all companies claiming this status were automatically included in this study. This status can be obtained by declaration to the Registry of the Commercial Court indicating a reason for existence, objectives, the methods of monitoring the execution of the mission (establishment of a mission committee and verification by a third party independent). This quality therefore makes it possible to publicly affirm objectives, but the ambition of these objectives still remains to be appreciated. It is for this reason that the selection focused on companies whose contribution to sustainable development issues was particularly visible.

Financial education

The selection of players presented in the section dedicated to financial education of this Panorama includes some of the companies in the sector. This selection approach focused on those that demonstrate strong or particular sustainability intentionality, aligned with the desired criteria for this panorama. Particular attention was paid to fintech offering innovative and accessible approaches, aimed at promoting a better understanding of financial issues. However, fintechs aimed at a niche audience, such as those specifically targeting children, were excluded from the selection.

Access to property, housing

A growing number of fintech companies offer digital solutions facilitating access to housing. Our selection method focused on companies whose solutions contribute not only to a significant reduction in access disparities, whether through new real estate financing methods, but also through the development of inclusive financial services aimed at to provide access to housing to disadvantaged populations and those in precarious financial situations, particularly those who are underrepresented or in vulnerable situations.

Split payment

The selection of entities highlighted in the sections dedicated to split payment was carried out with emphasis on those whose initiatives reflected a financial inclusion approach towards vulnerable populations, in accordance with the criteria established by the Banque de France concerning financial inclusion. In this process, certain entities which did not fully meet these specific financial inclusion criteria established by the Banque de France were excluded from the selection.

Responsible consumption and short circuits

Some fintechs have positioned themselves in the field of the circular economy by developing innovative solutions to meet the challenges of the digitalization of financial services, encompassing aspects such as peer-to-peer consumption, short circuits, as well as usage and property. These companies play a significant role in facilitating a transition among the public. However, it is important to emphasize that despite their substantial contribution to the promotion of more responsible and sustainable consumption, these companies do not meet the specific criteria defined by this overview. Therefore, their inclusion in this selection was not carried out. Nevertheless, it is our duty to mention their existence and their laudable commitment in this area.

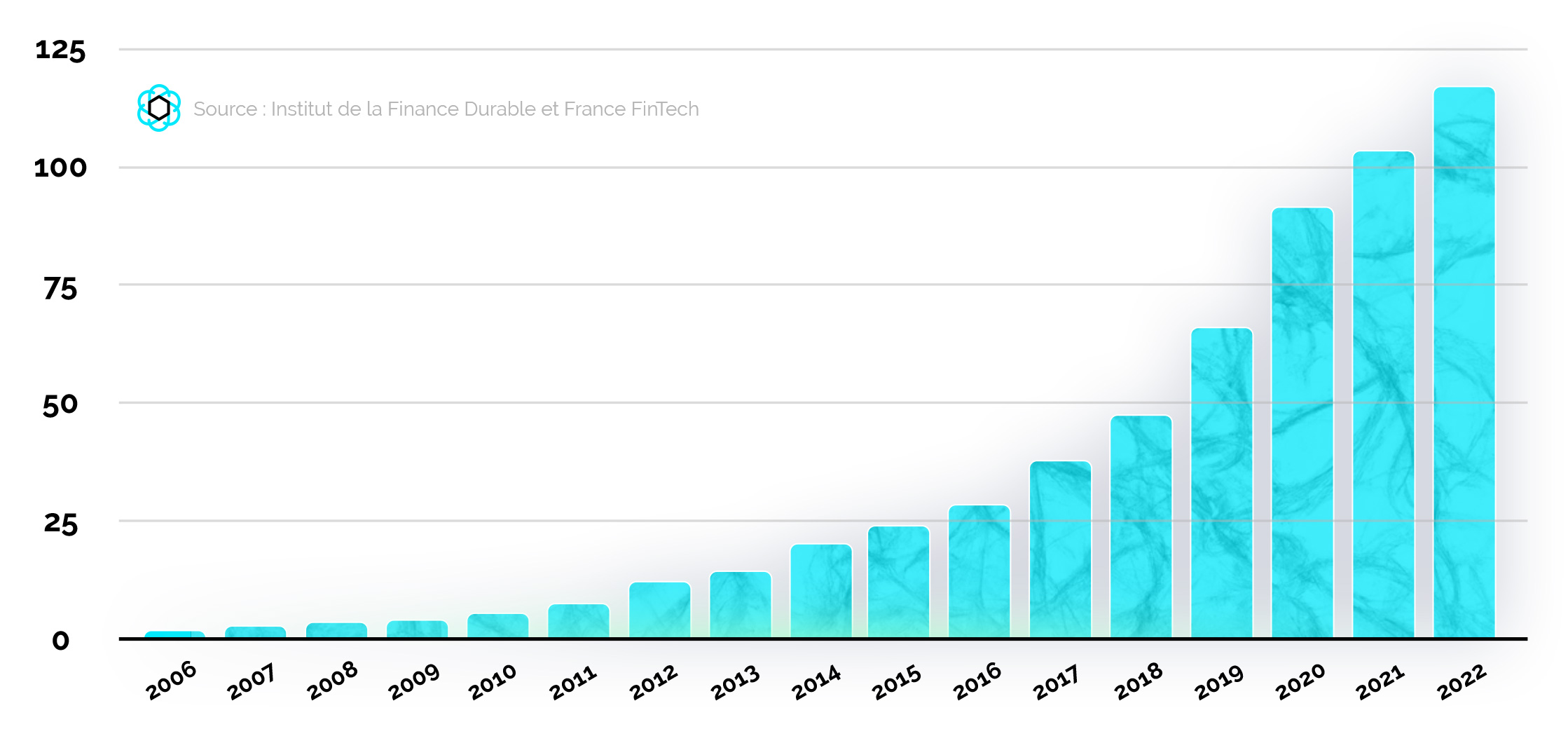

Evolution of the number of sustainable fintechs

The overview identifies 116 sustainable fintechs in France meeting the selection criteria. The sector has seen significant growth in terms of the number of active companies since 2017. Nearly 60% of them have been created in the last 4 years.

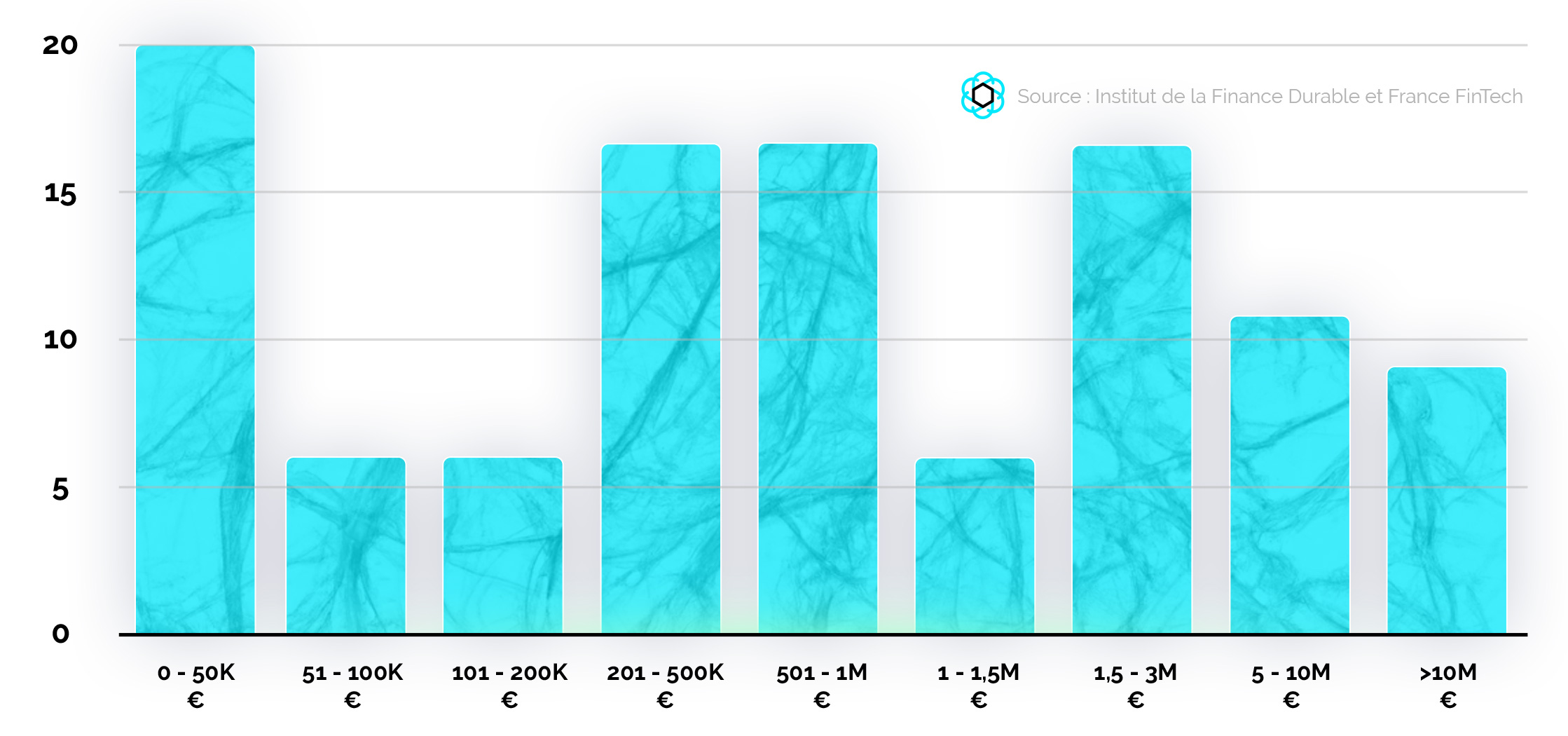

Distribution of sustainable fintechs by turnover

While the sector is emerging, more than 30% of sustainable fintechs already achieve a turnover greater than or equal to 1 million euros.

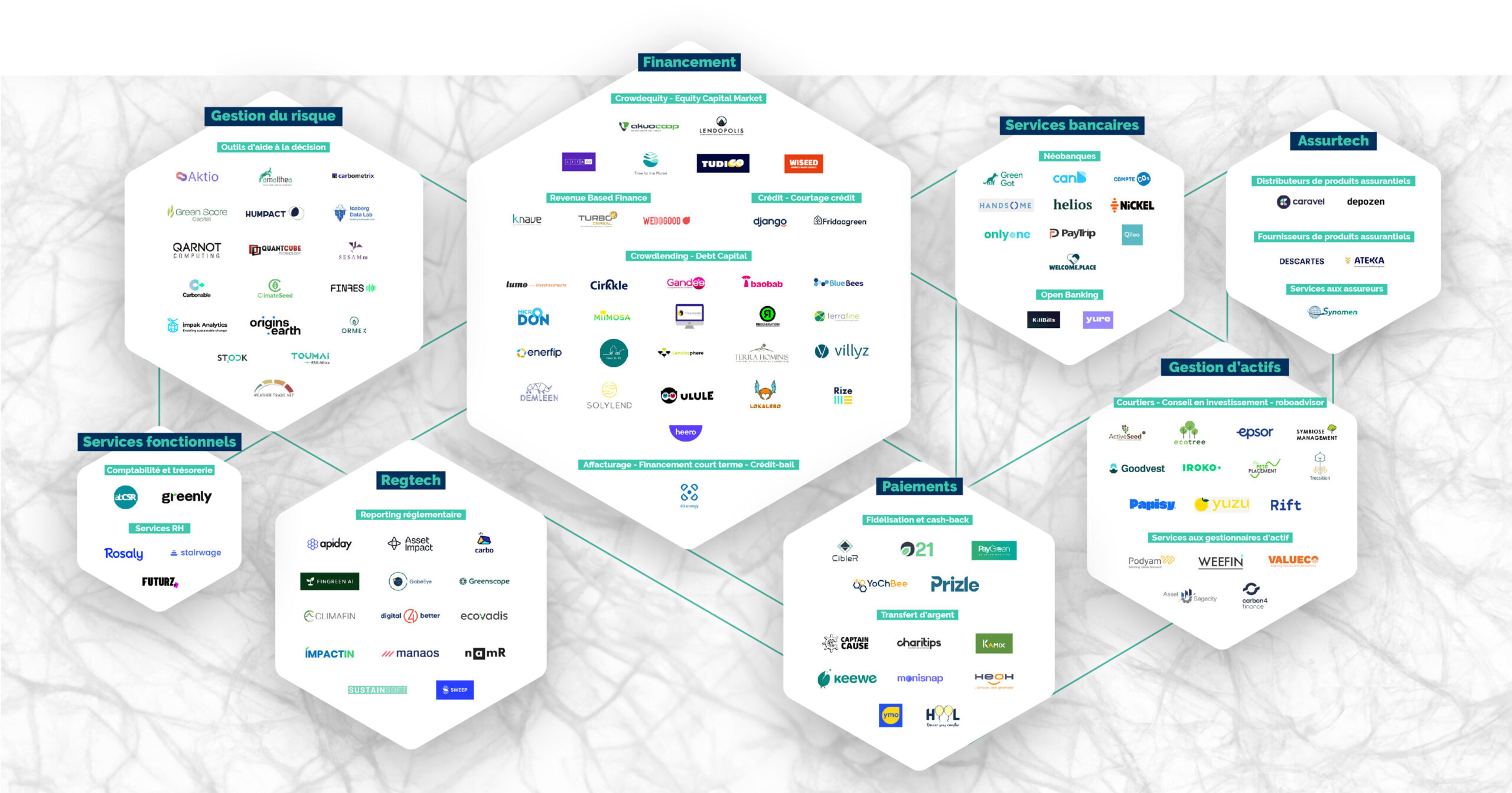

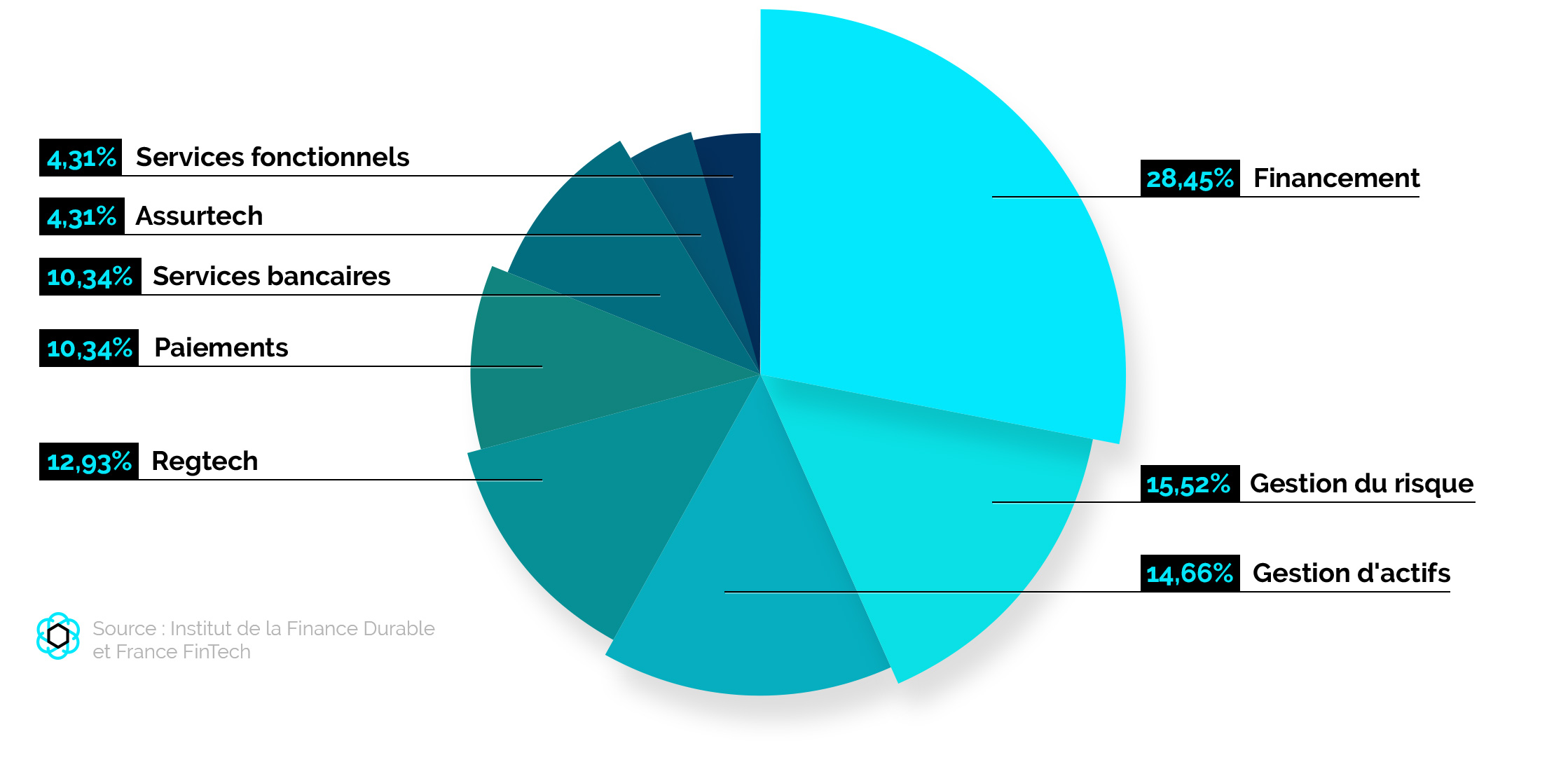

Distribution of sustainable fintechs by category

Crowdlending is a very developed financing solution. Nearly 30% of sustainable fintechs offer it, particularly to finance agricultural players and projects. The share of fintechs offering decision support tools represents 16% and mainly focuses on solutions for measuring the carbon footprint, carbon footprint and carbon footprint compensation. Players offering regulatory reporting solutions are also significant, representing almost 12% of sustainable fintech. The latter support all types of financial players in ESG and extra-financial analysis, and regulatory compliance.

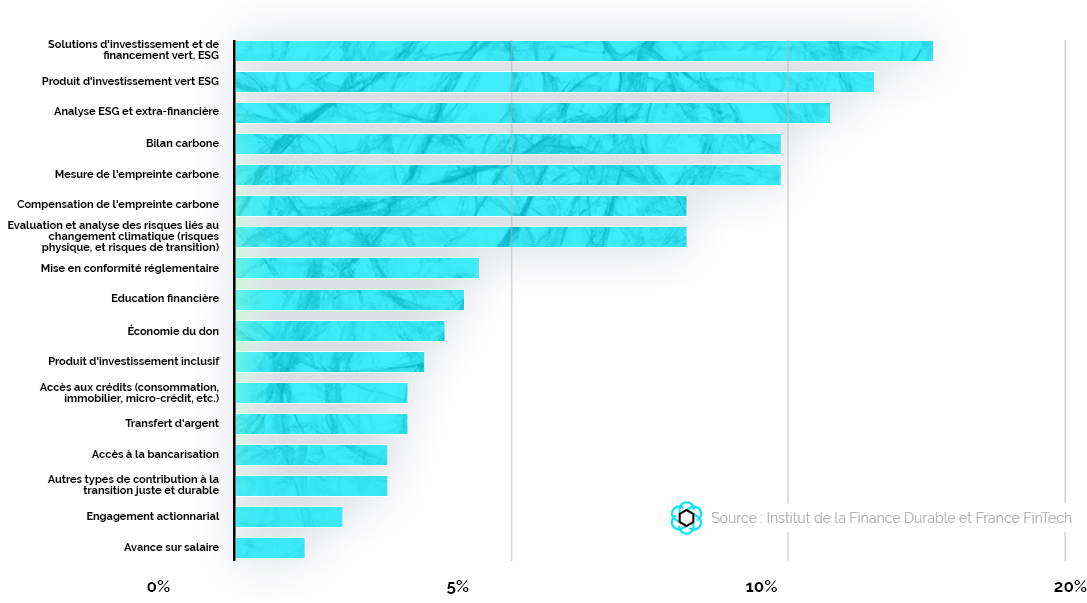

Contribution of fintech to the transition

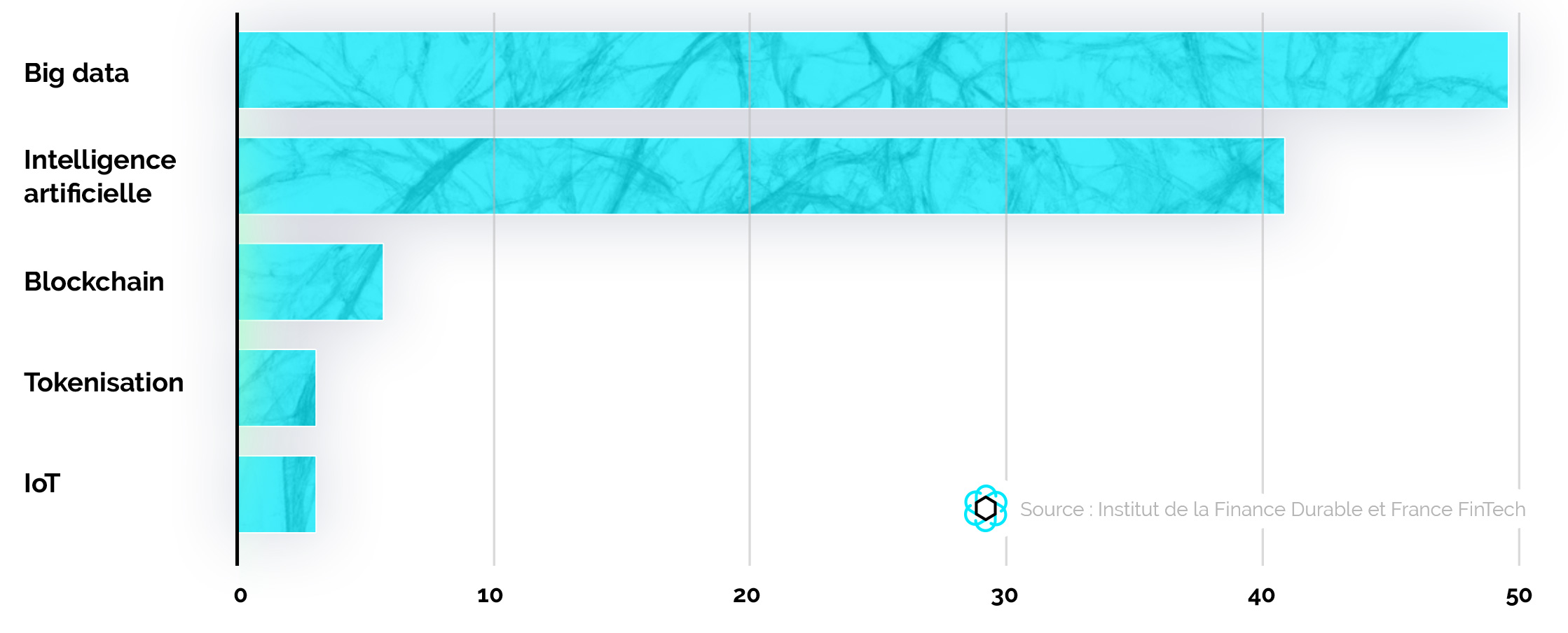

Use of technological features by sustainable fintechs

To support their development, sustainable fintechs use technology, mainly those linked to data. It is integrated at all strategic levels of the company, from customer vision to infrastructure.

About France FinTech

Created in 2015 at the initiative of entrepreneurs, brings together companies using innovative and disruptive operational, technological or economic models, aimed at addressing existing or emerging issues in the financial services industry and representing the main components of the sector. The association's mission is to promote excellence in the sector in France and abroad and to represent French fintech to public authorities, the regulator and the ecosystem. France FinTech is today the largest sectoral association of start-ups in France and Europe. It is chaired by Alain Clot and Kristen Charvin is its general delegate. Its steering committee brings together the founders and managers of AML Factory, Anaxago, Eldorado, Epso, Jenji, Kriptown, Lydia, +Simple, and October.

In addition to its actions in the regulatory and legislative fields, its numerous publications, its workshops and various meetings, the association organizes each year the benchmark event for the FinTech ecosystem R:Evolution.

France FinTech is a member of the ACPR-AMF Fintech Forum and a founding member of the [EDFA (European Digital Finance Association).

For more information : www.francefintech.org

hello@francefintech.org

About the Sustainable Finance Institute

The Institute of Sustainable Finance (IFD), a branch of Paris EUROPLACE, aims to coordinate and accelerate the action of the Paris financial center to achieve the energy and environmental transition.

The IFD was created in October 2022 and takes over from Finance For Tomorrow. It brings together more than 200 members of Paris EUROPLACE, financial players, companies, audit and consulting firms, data providers, think tanks, fintechs but also public authorities and supervisors, to federate and amplify the actions undertaken by institutions in the Paris market in terms of green and sustainable finance and supporting the transformation of the economy.

The IFD is chaired by Yves Perrier.

For more information :

About Ademe

At ADEME – the Ecological Transition Agency – we are resolutely committed to the fight against global warming and resource degradation.

On all fronts, we mobilize citizens, economic actors and territories, giving them the means to progress towards a resource-efficient, lower-carbon, more just and harmonious society.

In all areas – energy, circular economy, food, mobility, air quality, adaptation to climate change, soils, etc. – we advise, facilitate and help finance numerous projects, from research to the sharing of solutions.

At all levels, we put our expertise and foresight capabilities at the service of public policies.

ADEME is a public establishment under the supervision of the Ministry of Ecological Transition and Territorial Cohesion, the Ministry of Energy Transition and the Ministry of Higher Education and Research.

About Julhiet Sterwen

Julhiet Sterwen, one of the leaders in strategy, transformation and innovation consulting, advises and supports organizations to help them adapt to all of the changes we are going through. Its action focuses on the 5 pillars of transformation, business, people, agility, digital, environment thanks to its integrated and seamless model, unique on the market. A company with a mission, Julhiet Sterwen embodies “Consulting for Good” and believes it must generate a positive and lasting impact.

Key data: 500 employees, 85 million turnover, more than 1500 customers. Active in more than 40 countries, notably with its network, The Transformation League.

Holder of the Ecovadis platinum medal, the Happy@Work label, the BPI Excellence label from BPI France. Founding partner of France FinTech.

For more information : www.julhiet-sterwen.com

Judith Lengrand, Communications Director

+06 21 32 31 30 XNUMX

To go further in the knowledge of the ecosystem:

- White Paper Impact in Financial Services published by France FinTech in partnership with Julhiet Sterwen

- Panorama 2022 of French sustainable fintechs carried out by the IFD with ADEME

- 2021 infographic on impactful fintech published by France FinTech

- IFD organizes the Challenge for Tomorrow every year, the 6th edition of which will take place on October 9 as part of the French FinTech Week

Each year, France FinTech grants a sequence dedicated to impact and sustainability issues during FinTech R:evolution Fintech | Impact – YouTube