France FinTech and Bpifrance publish the 2023 PANORAMA OF FRENCH FINTECH on the occasion of FINTECH R:EVOLUTION #FFT23

Paris, October 16, 2023

For the eighth consecutive year, France FinTech, the representative association of the sector, presents the Annual panorama of French fintech, a reference document produced again this year in partnership with Bpifrance and published on the occasion of FinTech R: Evolution, the flagship event of the ecosystem.

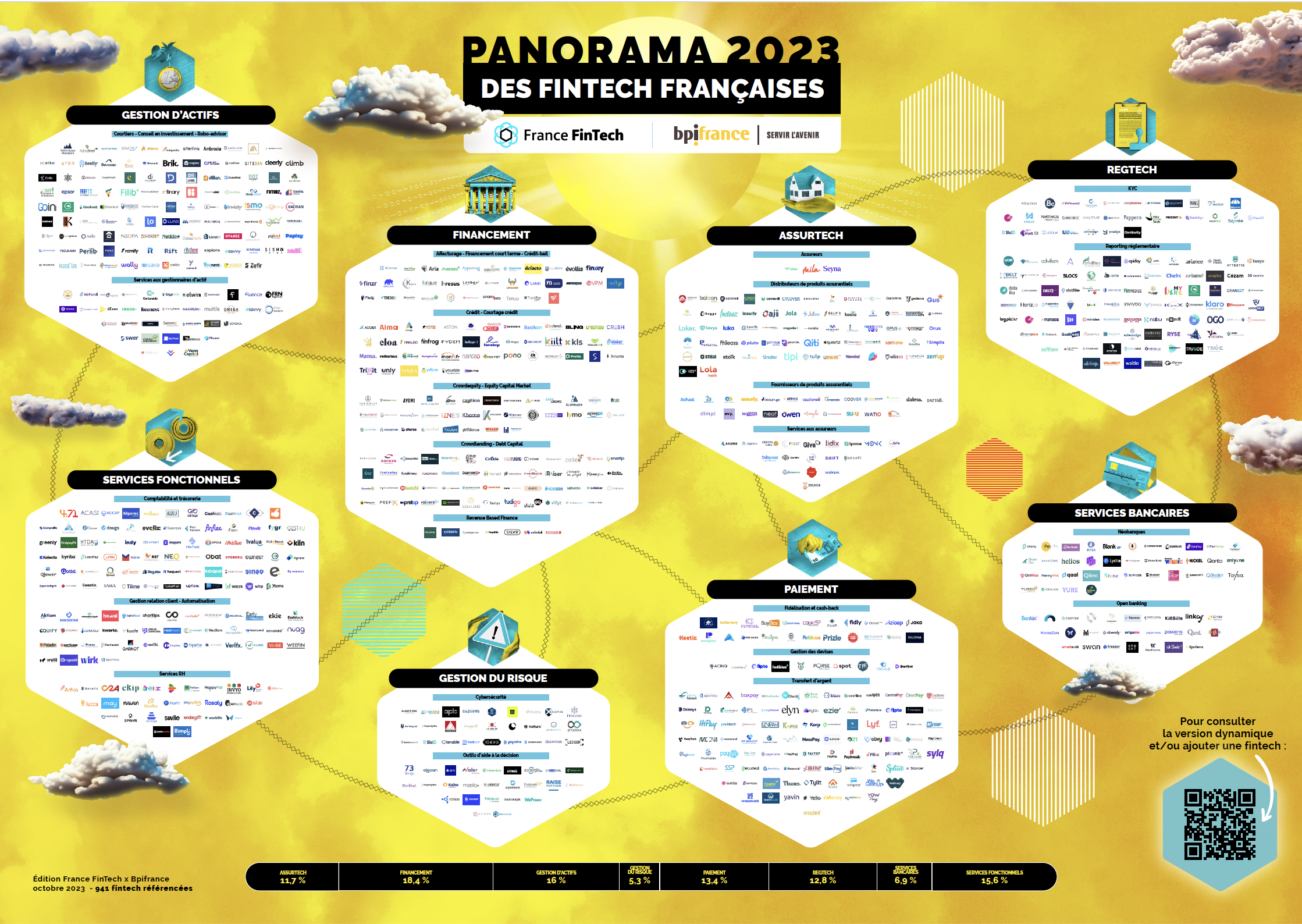

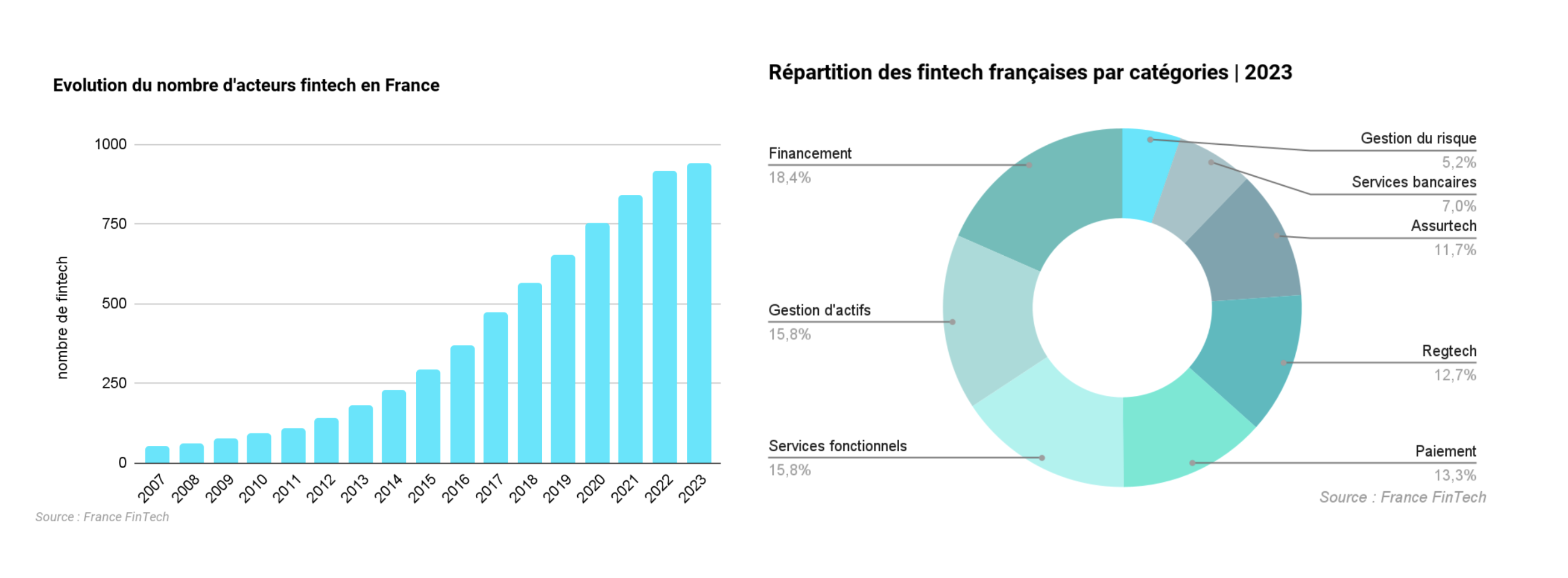

In total, almost 950 companies innovative financial services operating in banking, insurance, risk and asset management are referenced in this new edition. The overview identifies fintechs at different stages of development: start-ups, start-ups, scale-ups and unicorns. They are referenced using a nomenclature organized in 8 categories and 23 subcategories, in order to better reflect the diversity of activities, professions, clienteles and fields of application.

ACCESS THE PANORAMA OF FRENCH FINTECH 2023 (HD)

The study of the data used to produce the panorama allows a detailed analysis of the sector and reveals certain interesting trends. Especially :

- The strong development of segments such as web3, insurtech, or impact finance,

- The proliferation of investment platforms on increasingly diversified underlying assets accessible to the general public (real estate, unlisted, luxury assets, agricultural land),

- The rise of AI in fintech, particularly in support of customer acquisition, risk management and interaction with users,

- The growing share of models with recurring revenue/SaaS/subscription,

- The progression of offers aimed at VSEs/SMEs and investment funds,

- A trend that seems to be emerging towards the platformization of B2B services: significant expansion of the offering to businesses, integration of partner offers.

1. Overall, the ecosystem shows itself to be resilient to a difficult situation:

- French fintechs continue to develop their activity. While half of them are under 5 years old:

- 53% achieve more than €1 million in turnover (compared to 36% in 2022) (1),

- Turnover figures are constantly increasing (for the record, +23% in 2022) (2),

- More than ⅓ have already reached their break-even point in 2023 (compared to 28% in 2022) (3)

- They are consolidating their positions abroad: more than 30% are now established internationally.

- Even if certain projects have been postponed or abandoned due to the financing crisis, fintechs continue to invest:

- in human resources, certainly at a lower rate (+28% in 2023, compared to +48% in 2022 and +69% in 2021), but now bringing the number of jobs created in France to more than 50.

- in takeovers of companies which participate in the consolidation of the market: mergers and acquisitions operations, in 2023, concern in 56% of cases, operations between fintech. Note that French fintechs buy more of their foreign counterparts than the reverse.

2. This good performance of the ecosystem is all the more encouraging as the environment is turbulent, with:

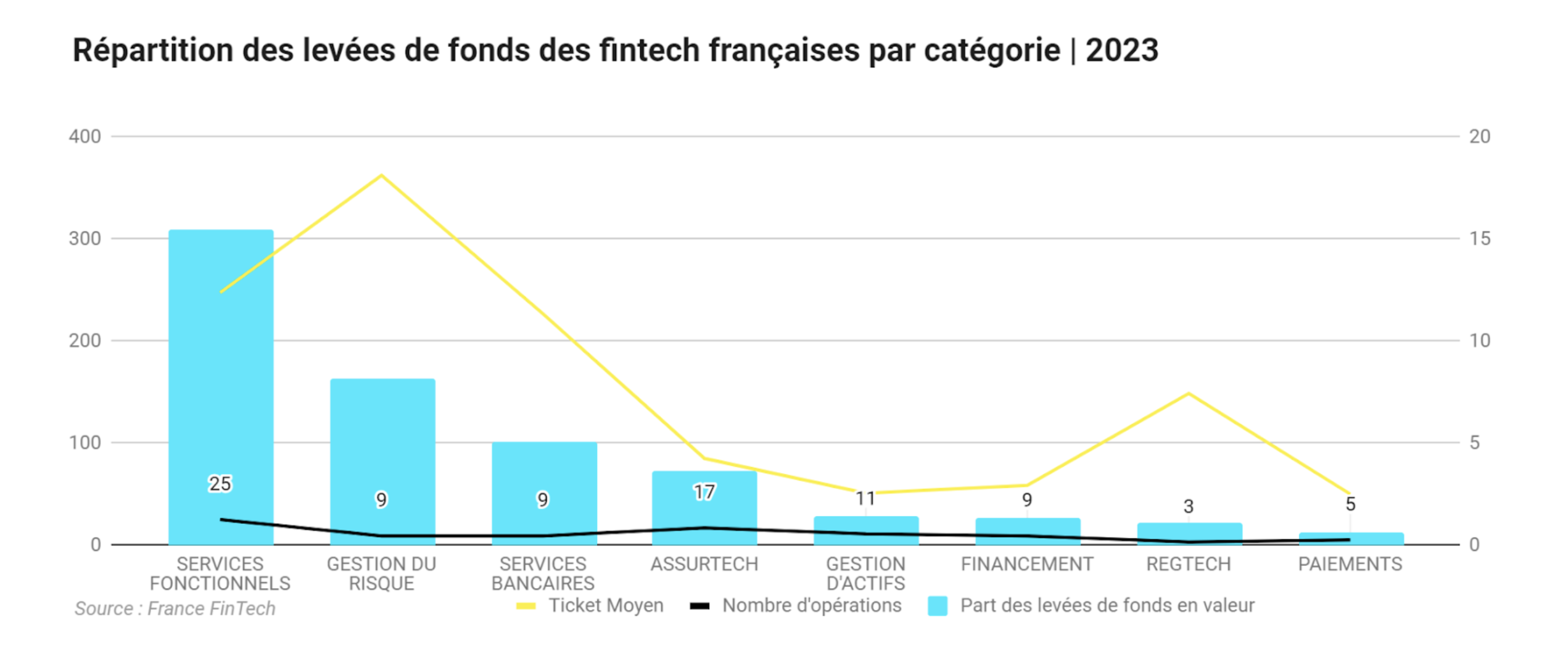

- Strong downward pressure on funding : as of September 30, French fintechs raised €736 million, a drop of 66% compared to the 9-month average for 2022.

Note that start-ups have resorted more to debt (+26% in 2022, to €5,4 billion). which represents 44% of equity compared to 37% in 2021. 83% of them resort to debt with a median value of €703 thousand (4).

LBO operations continue to grow (they represent 30% of exits from French start-ups in all sectors since 2021) (5). - A significant contraction in valuations (decrease of 25% between 2022 and 2021), even if fintech remains the 3rd most valuable sector of activity (more than 4 times turnover; behind software and health) (6).

Entrepreneurs in our French ecosystem are holding up quite well, perhaps even better than many of their foreign counterparts.

Fintech remains the leading ecosystem in the European Union in terms of fundraising and the leading compartment of French tech:

- It is the sector most represented within the French unicorns (10/27) and the Next 40 (35%).

- And in a good position in the new European LETS index: 9 of the 135 scale-ups identified are French fintechs (i.e. 6,6%), which represent 19% of the total French start-ups counted.

It is in reference to the contrasting character of this environment and the course maintained by our entrepreneurs, that this 2023 edition of FinTech R:Evolution, which will take place on Thursday October 19, 2023 at the Maison de la Mutualité, is called “ Riders on the storm ».

Having become the benchmark annual meeting for innovative finance, thanks to a selection of strategic themes and leading speakers in all fields, FinTech R: Evolution also stands out for its emphasis on debates and great freedom of tone. Punctuated by numerous conferences and discussions led by renowned speakers, this day will offer participants a global overview of the major issues in the sector.

More information and accreditations directly on FinTech R: Evolution :

(1) Source: France FinTech 2023

(2) source: The financial situation of start-ups in 2022, Bank of France, September 2023

(3) Source: France FinTech 2023

(4) source: The financial situation of start-ups in 2022, Bank of France, September 2023

(5) source: LBO operations make a breakthrough in French Tech, Les Echos, September 6, 2023

(6) Source: Avolta Partners study, 2022

To go further, see:

- Our barometers

- Le Overview of sustainable fintech, carried out in partnership with the Institute of Sustainable Finance (IFD)

- Fintech trends for the start of the 2023 school year

About Bpifrance

Bpifrance finances and supports companies – at each stage of their development – with credit, guarantees, support for innovation and equity. In doing so, Bpifrance acts in support of public policies conducted by the State and the Regions. Bpifrance supports them in their development, ecological and energy transition, innovation and international projects. Bpifrance also provides export financing in the name and on behalf of the State.

Bpifrance offers, in conjunction with recognized consulting firms and training organizations, support solutions adapted to start-ups, VSEs, SMEs and mid-sized companies. Thanks to its 50 regional locations, entrepreneurs benefit from a close and efficient contact to support them in the sustainable growth of their activity.

More information on: www.bpifrance.fr

Follow us on twitter : @Bpifrance - @BpifrancePresse

About France FinTech

Created in 2015 at the initiative of entrepreneurs, France FinTech brings together companies using innovative and disruptive operational, technological or economic models, aiming to address existing or emerging issues in the financial services industry and representing the main components of the sector. The association's mission is to promote excellence in the sector in France and abroad and to represent French fintech to public authorities, the regulator and the ecosystem. France FinTech is today the largest sectoral association of start-ups in France and Europe. It is chaired by Alain Clot and Kristen Charvin is its general delegate. Its steering committee brings together the founders and managers of +Simple, AML Factory, Anaxago, Eldorado, Epsor, Kriptown, Lydia, October and Silae. In addition to its actions in the regulatory and legislative fields, its numerous publications, its workshops and various meetings, the association organizes each year the benchmark event for the ecosystem, FinTech R:Evolution. France FinTech is a member of the ACPR-AMF Fintech Forum and a founding member of the EDFA (European Digital Finance Association).

More information on : www.francefintech.org

And follow us on X (Twitter) @FranceFinTech et LinkedIn

FinTech R:Evolution • #FFT23 • takes place as part of the 3rd French FinTech Week, organized jointly by the ACPR, the AMF, Paris&Co and France FinTech, whose programming extends from October 6 to 20, 2023.

Contacts

press [at] francefintech.org